The average American wedding cost about $35,000 last year, and that hefty price tag didn’t even include the honeymoon! What you didn’t know: If you’re familiar with the world of credit cards and rewards, you can get your honeymoon for almost nothing.

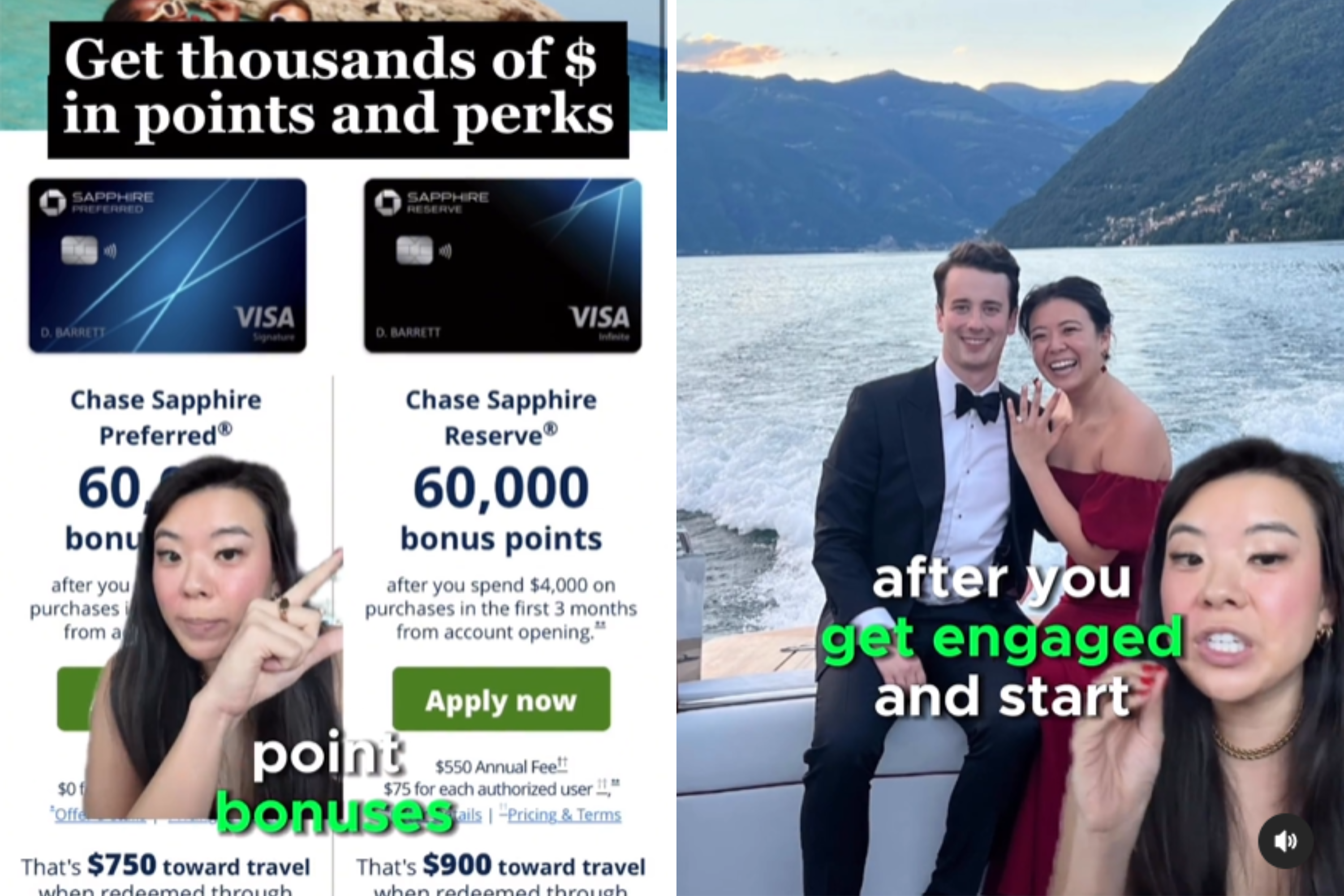

In a video that went viral in March and was shared on Instagram under the username @your.richbff, self-made millionaire and former Wall Street trader Vivian Tu explains how you can get free flights and/or hotel stays for your honeymoon simply by opening a new travel credit card as soon as you start planning your wedding.

Tu told Newsweek that many credit cards offer different perks and incentives, so it’s important that you find one that rewards you in a way that you like. And if traveling is important to you, then a travel-focused card may be right for you.

“Typically, these cards offer the highest points multipliers for things like flight and hotel bookings,” she said. “You can then redeem those points and rewards for free travel or hotel stays.”

your.richbff

How much money do you have to spend to get enough points?

In the viral post, Tu explains that most cards typically only offer rewards if you’ve spent thousands of dollars within a certain number of months, so you should open the card right when you start planning your wedding so you can collect all the points you get from paying for all the things related to the wedding and easily get the freebies.

“When you pay for things like your dress, these invitations, or the tuxedo rental, you will have the option to pay by credit card, and I will ask you to use this new credit card and no other cards,” she says in the clip.

“You will then receive your credit card’s welcome bonus for your wedding expenses, which you can then use for free flights or free hotels during your honeymoon.”

Rewards and sign-up bonuses as well as your minimum spend vary depending on the type of card you choose.

“I usually recommend not transferring the points directly through the credit card portal, but transferring them to a travel partner,” said Tu.

“Certain airlines, hotel chains and travel companies partner with these credit card companies. You can convert those points and then redeem them for travel. It’s just a great way to manage your daily spending so you can get some free travel with it as well.”

While we all have the right to want the best for our wedding, Tu cautions couples against spending too much money carelessly.

“Many couples go over budget when planning their wedding, and that’s OK,” she said. “Just make sure you can find that buffer somewhere else in your budget. Don’t go into debt for (your) wedding, don’t overspend, and don’t start your married life on precarious financial footing.”

“I know there are a lot of emotions involved and you are entitled to want whatever you want on your special day, but always try to balance that with making a smart decision and keeping your own financial future in mind.”

Other aspects to consider when opening a new credit card for rewards

Keith Spencer, CFP, founder and financial planner at Spencer Financial Planning and certified member of the Alliance of Comprehensive Planners (ACP), said Newsweek that you should pay attention to the fees when opening a credit card to receive the sign-up bonus.

“These cards often have annual fees, so you should think carefully about whether the extra cost is worth it and whether you want to keep the card after you receive the bonus,” he said.

“If you decide to close the account, you can do so any time before the next anniversary of the card opening. Credit card companies will often even refund the fee if you close the account shortly after the fee is charged on the one-year anniversary.”

However, he also explained that closing an account can impact your credit score.

“Canceling a credit card will increase your overall credit utilization ratio if everything else remains the same, which could slightly negatively affect your credit score. But I wouldn’t let that dictate your decision if it otherwise makes sense to close the account.”

If you don’t want to close the account but don’t want to pay fees either, Tu suggests downgrading your credit card to a fee-free card.

“Many of these providers often offer multiple card categories and have a fee-free card that you can easily downgrade to. However, these don’t necessarily offer as many perks or rewards,” she added.

When you should avoid opening a credit card

While credit cards can be a great way to afford some of your everyday expenses, they can also put you in debt if you don’t use them wisely.

Spencer says people struggling with debt and excessive spending should think carefully about applying for a credit card, as they may be without a better option.

“Any benefits you get from using credit cards are quickly wiped out by interest charges if you don’t pay the credit card off in full each month,” he said. “So if someone is struggling with debt and excessive spending, I usually recommend not using a credit card at all, but instead just using cash and/or debit cards.”

Do you have videos or stories you’d like to share? Send them to [email protected] with some additional details and they could appear on our site.