The most you can lose on a stock (assuming you don’t use leverage) is 100% of your money. But even a good company can see its share price rise by well over 100%. A good example is Intuitive Surgical, Inc. (NASDAQ:ISRG), whose stock price has increased by 181% in five years. Moreover, the stock price has increased by 22% in about a quarter. This could be related to the recently released financial results – for the most recent data, check out our company report.

With it being a strong week for Intuitive Surgical shareholders, let’s take a look at how the longer-term fundamentals are performing.

Check out our latest analysis for Intuitive Surgical

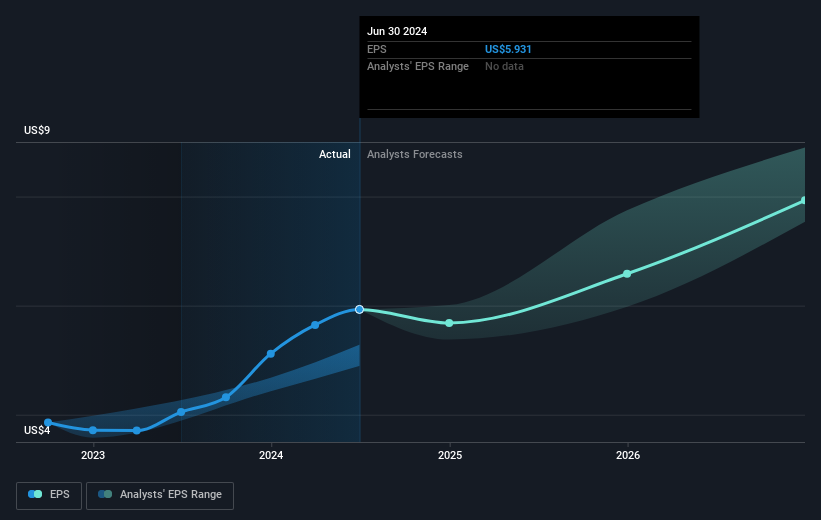

To paraphrase Benjamin Graham, in the short term, the market is a voting machine, but in the long term, it is a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a sense of how investors’ attitudes toward a company have changed over time.

During the five years of share price growth, Intuitive Surgical achieved compounded earnings per share (EPS) growth of 11% per year. This EPS growth is slower than the share price growth of 23% per year over the same period. So it’s fair to assume that the market has a higher opinion of the company than it did five years ago. And that’s hardly surprising given its growth track record. This optimism is reflected in its rather high P/E ratio of 78.66.

Below you can see how EPS has changed over time (click on the image to see the exact values).

We know that Intuitive Surgical has been improving its bottom line recently, but will it also increase its revenue? You can check it out here free Report with analysts’ sales forecasts.

A different perspective

It’s nice to see that Intuitive Surgical has rewarded shareholders with a total return of 52% over the last twelve months. That’s better than the 23% annualised return over half a decade, meaning the company has been doing better recently. Someone with an optimistic perspective might see the recent improvement in the TSR as an indication that the business itself is getting better over time. I find it very interesting to look at the share price over the long term as an indicator of business performance. But to really gain insight, we need to consider other information as well. For example, we found 1 warning signal for Intuitive Surgical that you should know before investing here.

If you would rather check out another company — one with potentially better financials — then don’t miss this free List of companies that have proven their ability to increase their earnings.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks currently trading on U.S. exchanges.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.