The waves Rolls Royce (LSE:RR) has made many investors richer over the past two years, but many analysts are increasingly concerned about the company’s valuation.

And now, with the stock trading at around 500 pence, those worried voices are louder than ever.

However, I do not believe the stock is undervalued. In fact, given the supportive trends across the company, I expect Rolls-Royce shares to continue to rise.

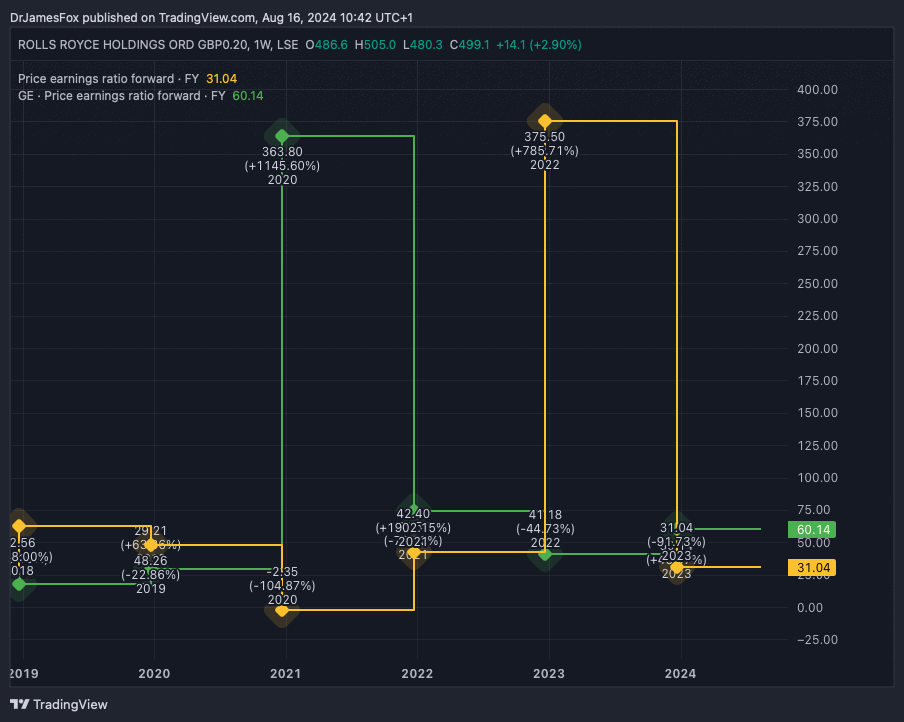

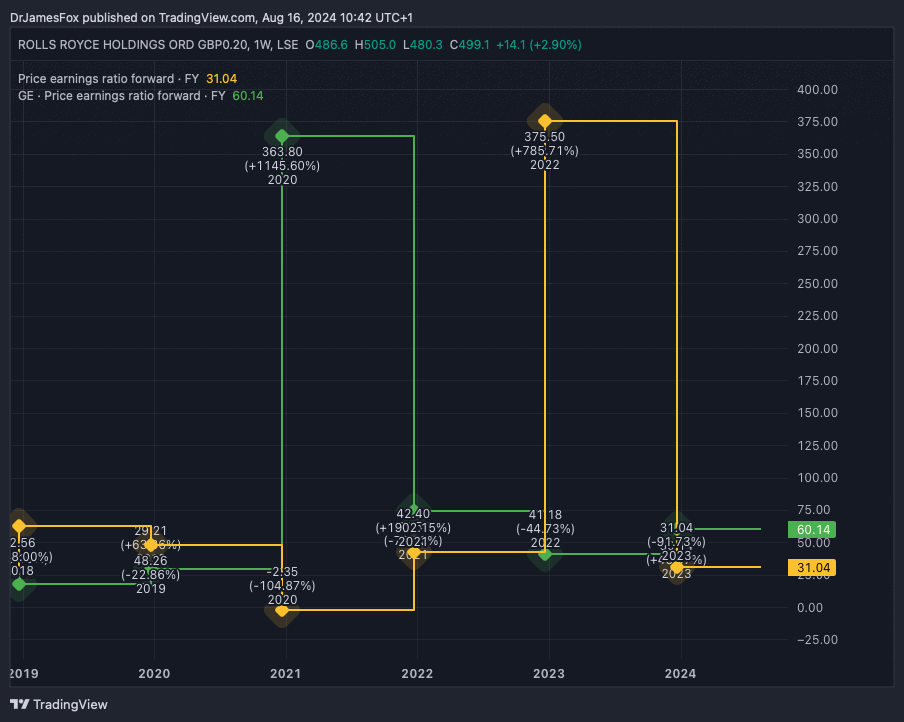

Price-earnings ratio

The price-earnings ratio (P/E ratio) is one of the most important metrics for assessing the value of a stock and determining whether a company is trading at a premium or discount compared to competitors.

Personally, I rarely use a trailing P/E ratio. Instead, I use the leading P/E ratio, which is calculated using the consensus for current year’s expected earnings.

As we can see below, Rolls-Royce is trading at 31 times forward earnings. That is expensive for the FTSE100but profit metrics are always context dependent.

So what’s the context? First, the engineering giant is expected to grow its earnings by 29.6% annually over the next three to five years. Most companies would be happy with high single-digit growth.

Second, Rolls-Royce operates three main businesses – civil aerospace, defence and energy systems. These are industries with enormous barriers to entry. You can’t just start making aircraft engines or nuclear propulsion systems for submarines. These are essentially closed sectors.

Third, it is cheaper than its main competitor in the aerospace industry. GE Aerospace.

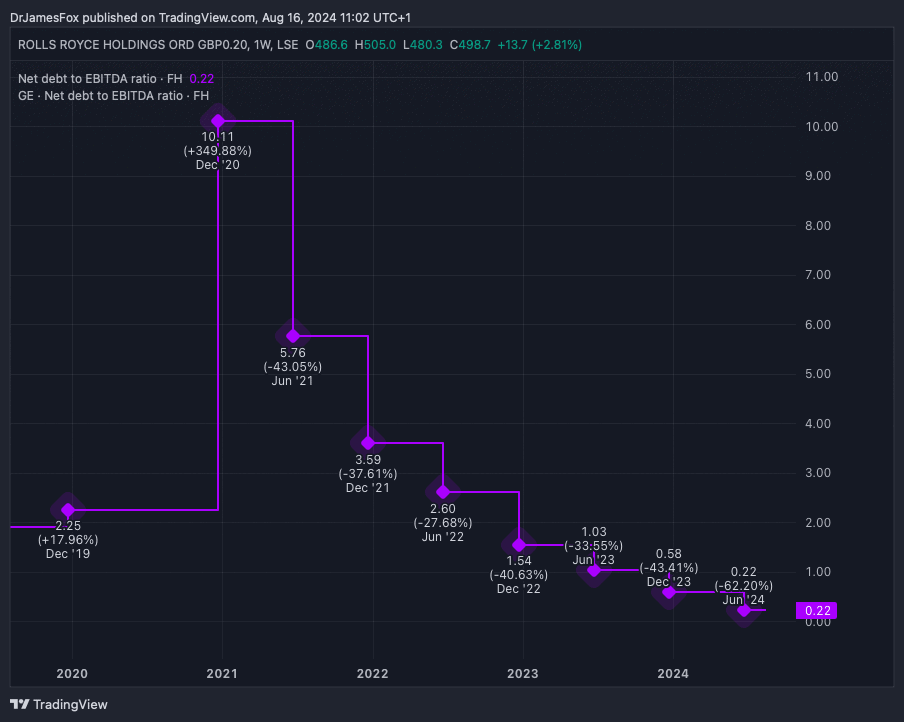

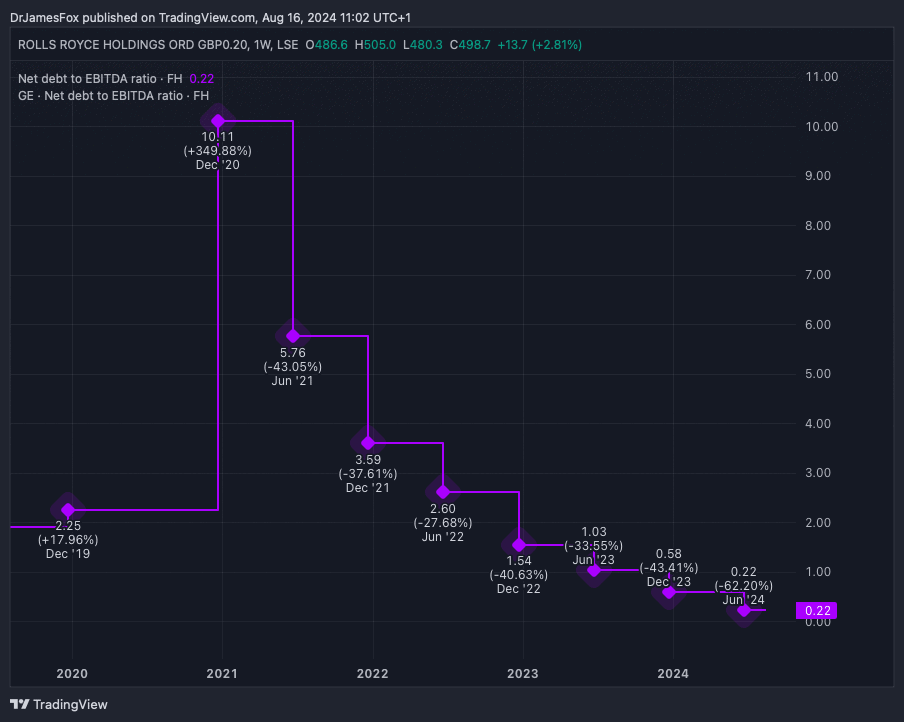

Net debt

Debt is not taken into account in the P/E ratio, but it is of course very important to know whether debt is likely to hinder the business.

This is especially important now as interest rates on variable loans are rising and the cost of issuing new debt is high.

Two years ago, analysts at major institutions around the world were wondering whether Rolls-Royce could survive given its debt levels. The company took out government-backed loans during the pandemic to keep going.

Today, however, the company is in a much better position. According to data from TradingView, the ratio of net debt to EBITDA has fallen significantly in recent years. Net debt is now only $1.2 billion.

The conclusion

Although I am optimistic about Rolls-Royce, some potential concerns should be mentioned. With a price-to-earnings ratio of over 30, expectations are high.

The company, which has beaten earnings expectations over the past 18 months, may need to continue doing so to maintain its momentum in the near term, which is why some analysts argue that the price is perfect for the company.

In addition, short-term momentum is likely to wane once the conflicts in Ukraine and the Middle East end. Rolls-Royce does not benefit directly from these contracts, but as a major arms supplier, the stock would likely react negatively.

The bottom line, however, is that Rolls-Royce operates in three segments that are also showing positive trends, so earnings growth expectations are substantial and the average price target on the stock is now 551p. I may consider adding to my own holdings.

The post “Is Rolls-Royce’s 500p share price just a joke? Here’s what the charts say” first appeared on The Motley Fool UK.

Further reading

James Fox holds positions in Rolls-Royce Plc. The Motley Fool UK has recommended Rolls-Royce Plc. The views expressed on companies mentioned in this article are those of the author and may therefore differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool, we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024