Lawyer advertising

Scott D. Owens, PA

Scott D. Owens, Esq.

Hollywood, Florida

Document violations: Who is affected?

Did a company print too much information on your credit or debit card receipt? If so, the company may have violated federal law and you may be entitled to compensation.

The Fair and Accurate Credit Transactions Act (FACTA) is designed to prevent consumers’ private information from being disclosed on receipts to prevent identity theft. Under FACTA, businesses are only allowed to print the last five digits of a card number on receipts and are not allowed to include any part of the card’s expiration date.

FACTA covers revenue for:

- Credit card and debit card transactions

- EBT card transactions

- ATM transactions

- “Top-ups” on prepaid debit cards

When companies violate FACTA, consumers can participate in class action lawsuits. These lawsuits can result in significant settlements and hold companies accountable for improperly handling confidential financial information.

Examples of recent FACTA class action settlements include:

- $30.9 million settlement with Subway

- Ikea payment settlement of $24.25 million

- $20 million settlement involving Safeway gas station receipts

Don’t wait to hold companies accountable that compromise your sensitive data. If you have receipts where your credit or debit card information was not properly abbreviated, Fill out the form now to see if you are eligible for a FACTA class action lawsuit.

Do you meet the requirements?

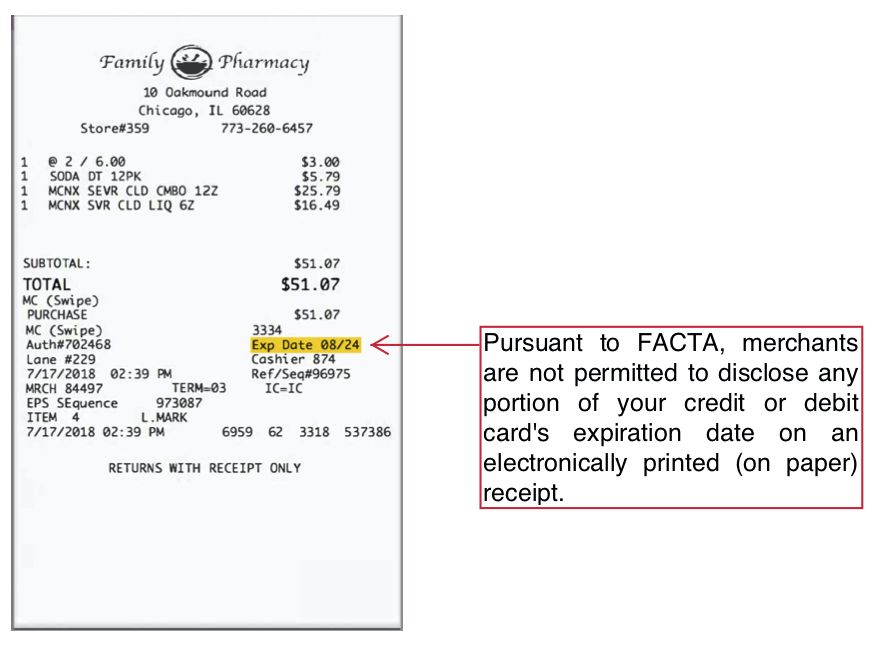

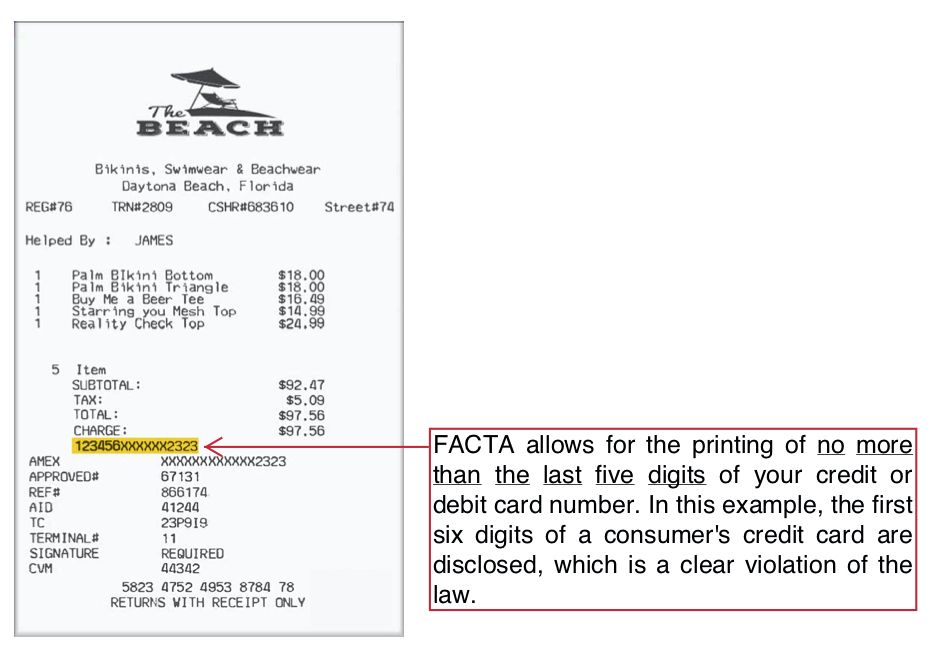

The following examples show what a violation of the Fair and Accurate Credit Transactions Act might look like. FACTA covers credit and debit cards, including non-traditional cards such as prepaid debit cards and EBT cards.

For more information, please fill out the form on this page.

What is FACTA?

The Fair and Accurate Credit Transactions Act (FACTA) is a federal law enacted in 2003 to improve consumer protections in financial transactions. This law amends the Fair Credit Reporting Act with the goal of combating identity theft and improving the accuracy of consumer reports.

What is the correct format for a credit or debit card receipt?

Merchants can comply with FACTA laws on credit card receipts by censoring private information through truncation. Truncation involves hiding numbers with symbols such as * or #. These symbols act as placeholders in the system while protecting sensitive credit card information.

For example, a properly abbreviated receipt might look like this:

ACCOUNT: **** **** ***0 1234

Experience: ****

Receipts that do not meet the FACTA abatement requirement can increase a consumer’s risk of having their private credit or debit card information stolen.

What are some examples of unacceptable card receipt formats?

If suppliers print a receipt that contains digits of a credit or debit card number other than the last five digits, they may be in violation of FACTA. The following truncation errors are examples of FACTA violations. Example 1 is the most common violation:

- Example 1: 1111 22** **** 4444

- Example 2: 1111 **** **** 4444

- Example 3: **** **** ** 444444

Also, if merchants print fewer than five digits of a card number, they may be in violation of FACTA if those digits are not the last digits on a card.

The restrictions on the expiration date of a card are equally strict, as the seller is not allowed to print expiration date information. The following expiration date information is an example of FACTA violations:

- Example 1: EXP: 03/17

- Example 2: EXP: 03/2017

- Example 3: EXP: 032017

- Example 4: EXP: 0317

- Example 5: Expires: 0317

- Example 6: Expiry date: 17.03.

- Example 7: Expiry date: 31.03.17

- Example 8: EXPIRY: 17.03.

- Example 9: 17.03.

- Example 10: 0317

- Example 11: Date 03/**

- Example 12: **/17

- Example 13: 2017/03

What happens if I have evidence of FACTA violations?

Stores, restaurants, and other vendors that print receipts with more than permitted information violate consumer rights under FACTA.

In these cases, you may be able to recover between $100 and $1,000 by joining a class action lawsuit under FACTA.

Consumers who serve as lead plaintiffs in successful FACTA class action lawsuits may also receive additional awards. Some have received up to $20,000 in these cases. Awards are Discretion and decided by the Court on the basis of factors such as the specific services provided by the Group Representatives to the Group, any potential risks they took and the amount of the award in relation to the total compensation.

If you have credit or debit card receipts that do not properly conceal information, you may be eligible to participate in this FACTA class action lawsuit investigation.

Scott D. Owens has litigated five of the largest FACTA recoveries. The class action settlements he has obtained include:

Fill out the form on this page to see if you qualify for a free case evaluation.