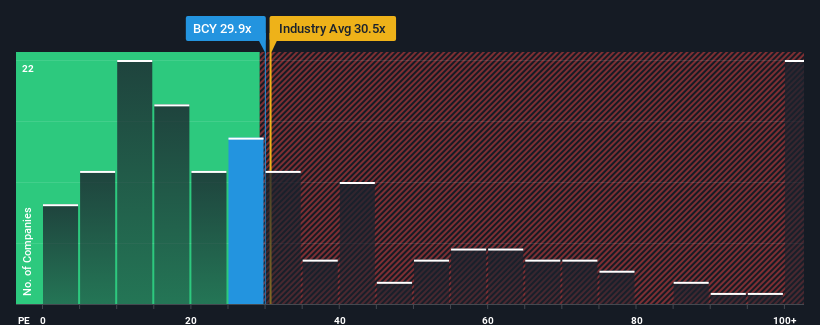

With nearly half of Singapore companies having a price-to-earnings (P/E) ratio of less than 10x, you may consider Powermatic Data Systems Limited (SGX:BCY) is a stock to avoid at all costs with its P/E ratio of 29.9. However, we would have to dig a little deeper to determine if there is a rational basis for the greatly elevated P/E ratio.

For example, consider that Powermatic Data Systems’ financial performance has been poor recently as earnings have been declining. It could be that many expect the company to still outperform most other companies in the coming period, which has prevented the P/E ratio from collapsing. One would really hope so, otherwise you’re paying a pretty high price for no particular reason.

Check out our latest analysis for Powermatic Data Systems

We don’t have analyst forecasts, but you can see how recent trends are positioning the company for the future by checking out our free Powermatic Data Systems earnings, revenue and cash flow report.

How is Powermatic Data Systems growing?

Powermatic Data Systems’ P/E ratio would be typical of a company expected to deliver very strong growth and, more importantly, significantly outperform the market.

If we look at the earnings over the last year, we are disheartened to see that the company’s earnings have fallen by 56%. As a result, the earnings from three years ago have also fallen by a total of 44%. So, unfortunately, we have to admit that the company has not done a great job of increasing its earnings during this time.

If you compare this medium-term earnings trend with the broader market’s one-year forecast of 12% growth, it’s not a pretty prospect.

Given this information, we find it concerning that Powermatic Data Systems is trading at a higher P/E than the market. It seems that most investors are ignoring the recent weak growth rate and hoping for a turnaround in the company’s business prospects. Only the bravest would assume that these prices are sustainable, as a continuation of recent earnings trends will likely weigh heavily on the share price eventually.

What can we learn from Powermatic Data Systems’ P/E ratio?

Although the price-earnings ratio should not be the deciding factor in whether or not you buy a stock, it is still a useful indicator of earnings expectations.

We have noted that Powermatic Data Systems is currently trading at a significantly higher P/E than expected, given that recent earnings have been declining over the medium term. At the moment, we are increasingly unhappy with the high P/E, given that this earnings trend is most likely not going to sustain such a positive sentiment for long. If recent medium-term earnings trends continue, shareholders’ investments will be significantly at risk and potential investors will risk paying an inflated premium.

You must consider risks, for example – Powermatic Data Systems has 5 warning signs (and 1 that is possibly serious) that we think you should know about.

If you are interested in P/E ratiosyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.