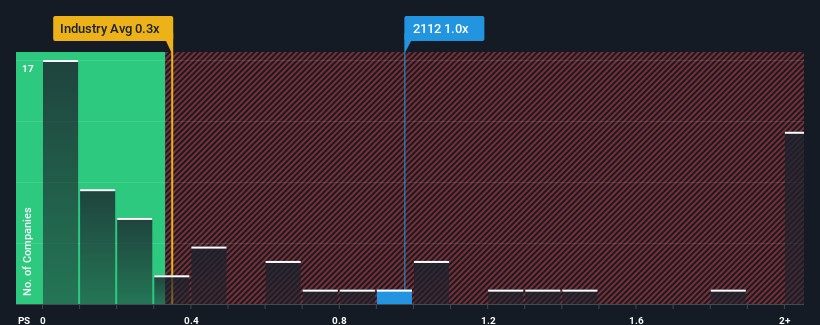

Grace Life-tech Holdings Limited’s (HKG:2112) price-to-sales ratio (or “P/S”) of 1x may not seem like an attractive investment opportunity considering that nearly half of the companies in Hong Kong’s retail distribution industry have a P/S ratio of under 0.3x. Still, we would have to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Grace Life-tech Holdings

What is Grace Life-tech Holdings’ recent performance?

For example, Grace Life-tech Holdings’ recent declining revenues should give us cause for concern. One possibility is that the P/S is high because investors believe the company will still do enough in the near future to outperform the industry as a whole. You really should hope so, otherwise you’re paying a pretty high price for no particular reason.

Do you want a complete overview of the company’s profit, sales and cash flow? Then free The report on Grace Life-tech Holdings will help you shed light on the historical performance of this company.

Is Grace Life-tech Holdings forecast to have sufficient revenue growth?

A P/S ratio as high as that of Grace Life-tech Holdings would only be truly comfortable if the company’s growth is on track to outperform the industry.

Looking back, last year saw a frustrating 16% drop in sales. The last three years don’t look good either, with the company’s sales declining by a total of 2.2%. Therefore, it’s fair to say that the sales growth of late has been unwelcome for the company.

If you compare this medium-term sales development with the one-year forecast for the entire industry, which assumes growth of 34%, this is not a good prospect.

Given this information, we find it concerning that Grace Life-tech Holdings is trading at a higher price-to-earnings ratio than the industry. It seems that most investors are ignoring the recent weak growth rate and hoping for a turnaround in the company’s business prospects. There is a very good chance that existing shareholders are setting themselves up for future disappointment if the price-to-earnings ratio falls to levels more in line with recent negative growth rates.

The conclusion on the price-earnings ratio of Grace Life-tech Holdings

In general, we prefer to use the price-to-sales ratio only when we want to determine what the market thinks about the overall health of a company.

Our research into Grace Life-tech Holdings found that declining revenues over the medium term do not translate into a P/S ratio as low as we expected, as the industry is geared towards growth. When we see revenues declining and falling short of industry forecasts, we believe the possibility of a decline in the share price is very real, bringing the P/S ratio back into the realm of reasonableness. Unless the circumstances of the recent medium-term performance improve, it would not be wrong to expect a difficult time for the company’s shareholders.

You should also inform yourself about these 5 warning signs we discovered at Grace Life-tech Holdings (including 3 that make us uncomfortable).

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.