Lemonade, Inc. (NYSE:LMND) shares had a terrible month, losing 27% after a relatively good period prior. Longer term, the stock has been solid despite a difficult 30 days, gaining 17% over the past year.

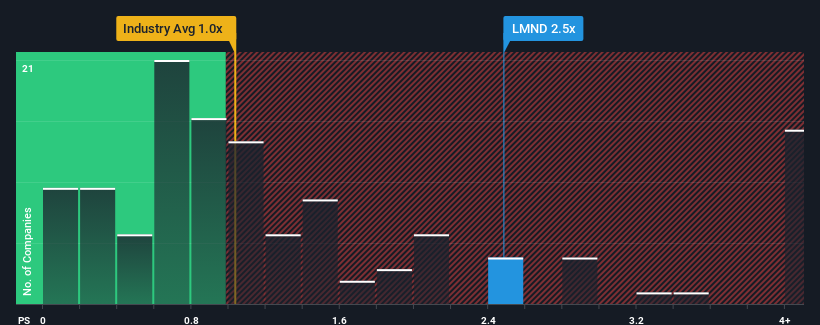

Although the price has dropped significantly while nearly half of the companies in the U.S. insurance industry have price-to-sales (or “P/S”) ratios below 1x, Lemonade’s P/S ratio of 2.5x probably still makes it a stock not worth researching. Still, we would have to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Lemonade

How Lemonade performed

Lemonade has done relatively well recently with revenue growth that is better than most other companies. The price-to-earnings ratio is probably so high because investors expect this strong revenue performance to continue. However, if it doesn’t, investors could find themselves in a situation where they are overpaying for the stock.

Do you want the full picture of analyst estimates for the company? Then our free The Lemonade report will help you figure out what’s on the horizon.

Do the sales forecasts correspond to the high P/S ratio?

To justify its P/S ratio, Lemonade would need to deliver impressive cross-industry growth.

Looking back, last year saw the company achieve an exceptional 30% increase in revenue. This great achievement means that the company has also achieved tremendous revenue growth over the last three years. Therefore, it is fair to say that the company’s revenue growth has been outstanding recently.

Looking ahead, the nine analysts who cover the company expect revenue to grow 26% annually over the next three years, well above the 3.8% annual growth forecast for the industry as a whole.

With this information, we can see why Lemonade trades at such a high price-to-earnings ratio relative to the industry. It seems shareholders aren’t interested in dumping something that potentially has a better future ahead of it.

The conclusion on Lemonade’s P/S

Despite recent share price weakness, Lemonade’s price-to-sales ratio is still higher than most other companies in the industry. While the price-to-sales ratio shouldn’t be the deciding factor in whether or not to buy a stock, it is a useful indicator of sales expectations.

We’ve noted that Lemonade maintains its high P/S ratio because its forecast revenue growth is expected to be higher than the rest of the insurance industry. It seems shareholders have confidence in the company’s future revenues, which supports the P/S ratio. Under these circumstances, it’s hard to imagine the stock price falling much in the near future.

It is also worth noting that we found 1 warning sign for lemonade that you need to take into account.

If this Risks make you rethink your opinion of Lemonadeexplore our interactive list of high-quality stocks to get a sense of what else is out there.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.