For many young people, entering the housing market is no small feat.

A housing shortage and the seemingly ever-increasing cost of living can be just some of the hurdles that make the first step on the property ladder difficult.

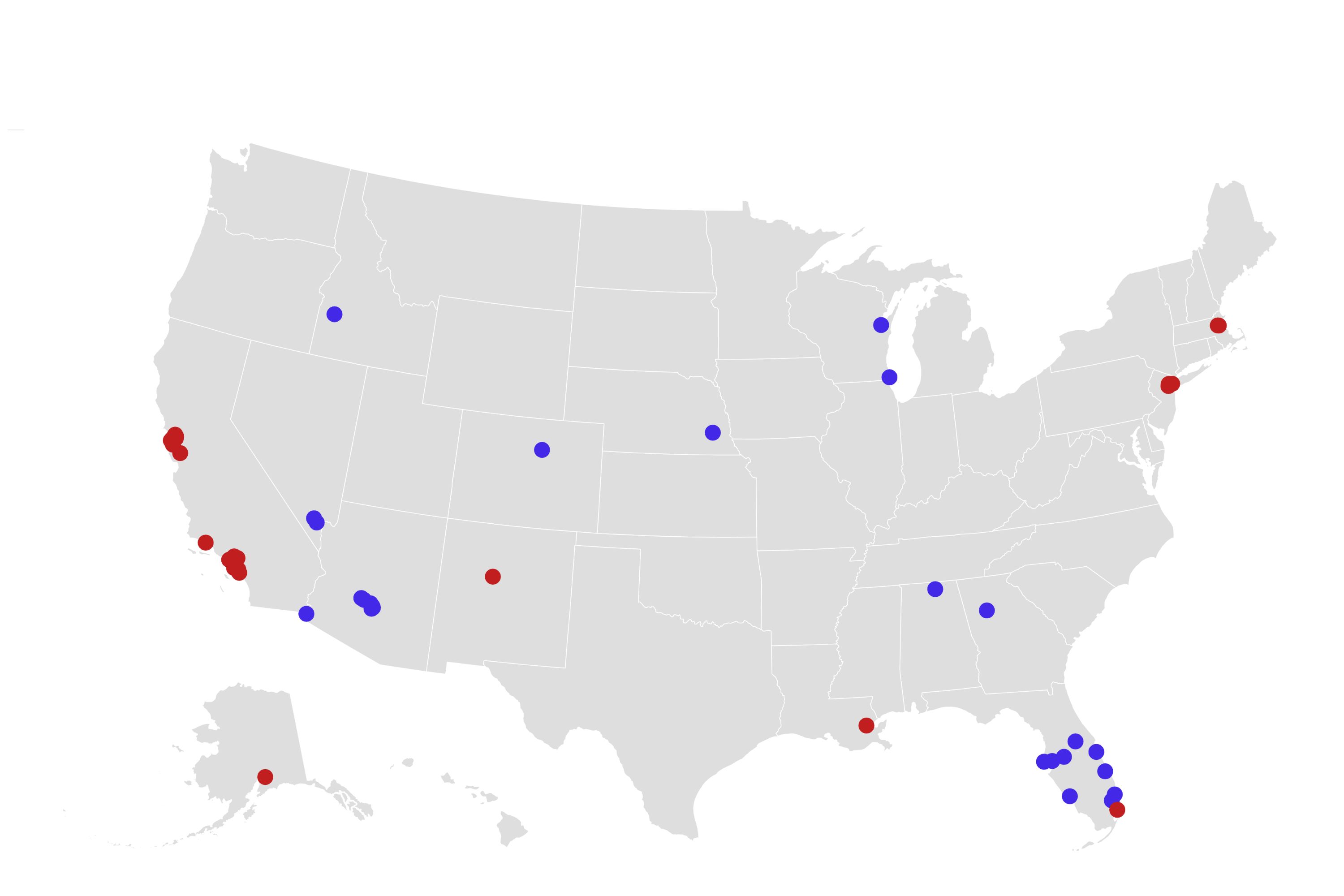

Newsweek has identified the best and worst cities for first-time buyers, according to a recent study by WalletHub.

The study, released last month, compared 300 cities of varying sizes on market attractiveness, affordability and quality of life using a dataset ranging from cost of living to property taxes and crime rates.

According to the study’s figures, the top 10 cities for first-time buyers were:

- Palm Bay, Florida

- Cape Coral, Florida: A day full of history and culture

- Port St. Lucie, Florida

- Tampa, Florida (state)

- Orlando, FL

- Surprise, Arizona

- Lakeland, Florida

- Boise, Idaho

- Gilbert, Arizona

- Henderson, NV

First place went to Florida’s Palm Bay, which led the nation in both the number of home listings per capita and the number of building permits per capita – suggesting that the area has an ample supply of housing. According to the study, Palm Bay had the third-highest homeownership rate among millennials.

The city was also known for its rate of home appreciation – WalletHub said Palm Bay homes were worth 106 percent more in 2022 than in 2016.

Cape Coral and Port St. Lucie were also praised in the study for their high number of home listings and building permits, as well as their low crime rates compared to many other cities included in the report.

Eight of the ten worst-rated cities were in California: Berkeley, Santa Monica, Santa Barbara, Oakland, San Francisco, Los Angeles, Glendale and Costa Mesa.

“In California, eight of the 10 worst cities for first-time home buyers rank poorly due to high costs of living, high housing prices and competitive markets,” said Cassandra Happe, analyst at WalletHub. Newsweek“These factors make it difficult for new buyers to afford a home and cause them to look for more affordable housing in other states.”

The report comes in an election year, which may impact the real estate market.

“There is certainly a human factor in home prices and mortgage rates. As a result, election years can bring more volatility in prices and interest rates than in non-election years. However, these moments of volatility are fleeting,” Jason Obradovich, chief investment officer at mortgage lender New American Funding, told Newsweek.

“Overall, the impact on the market is slower and less susceptible to sentiment swings. It is always best to look at the real estate market from a long-term perspective,” he added.

Obradovich also said Newsweek that the outcome of the November elections could have an impact on real estate prices in the USA

“What affects the housing market more than anything else in election years is the market’s reaction to the election outcome. If the market believes that the party that wins the election will boost growth, then we could see positive effects on the overall economic outlook,” he said.

“Unfortunately, the challenges affecting the housing market today are structural rather than political. This means that it will be very difficult for any government to do anything that will really impact the market.”

Do you have a story we should cover? Do you have questions about housing prices in your state? Contact [email protected]