Link: Apply now for the Marriott Bonvoy Brilliant® American Express® Card

The Marriott Bonvoy Brilliant® American Express® Card (review) is Marriott’s highest-value co-branded credit card, and there are many reasons to choose it, including a great welcome offer.

While the annual fee for the card is a hefty $650, I find that fee is easily justified thanks to benefits like Marriott Bonvoy Platinum status, 25 elite nights toward status per year, an annual free night, a $300 annual dining credit, and more.

In this post, I wanted to take a closer look at how the card’s $300 annual dining credit works. While this benefit (annoyingly) has to be used monthly, I find it’s pretty easy to maximize, so I wanted to go over those details.

Marriott Bonvoy Brilliant Card Details: $300 Restaurant Credit

The Marriott Bonvoy Brilliant Card offers up to $300 in dining credits per calendar year in the form of a $25 monthly credit. As you might expect, there are a few terms and conditions to be aware of:

- The $300 credit will be broken down into $25 monthly credits, allowing you to receive up to $25 in credit each calendar month.

- The credit is valid for restaurant purchases worldwide and is not limited to purchases in the USA.

- The credit is not valid for the purchase of gift cards or merchandise or for purchases at non-restaurant retailers, including nightclubs, convenience stores, grocery stores and supermarkets.

- Whether a purchase is eligible for the credit depends on how the retailer classifies itself

- It may take 8-12 weeks after a qualifying purchase for credit to be posted, but in practice credit is usually posted sooner.

- Eligible purchases can be made by either the base cardholder or an authorized user, but you will still only receive up to $300 in total credits per year.

- No registration is required to benefit as long as you make the correct, eligible purchases with the card

How to use the Marriott Bonvoy Brilliant Card’s $300 dining credit

Amex cards are known for splitting credits on a monthly, quarterly or semi-annual basis. Presumably, this is partly to increase wallet share by constantly reminding consumers to use a particular card. Of course, the split is also an important factor.

Personally, I don’t use the Marriott Bonvoy Brilliant Card for most of my dining out, as there are much more worthwhile dining cards out there in terms of the bonus points they offer, so I don’t want to spend $1,000 a month dining out on a card just to get a $25 statement credit and then miss out on a lot of rewards.

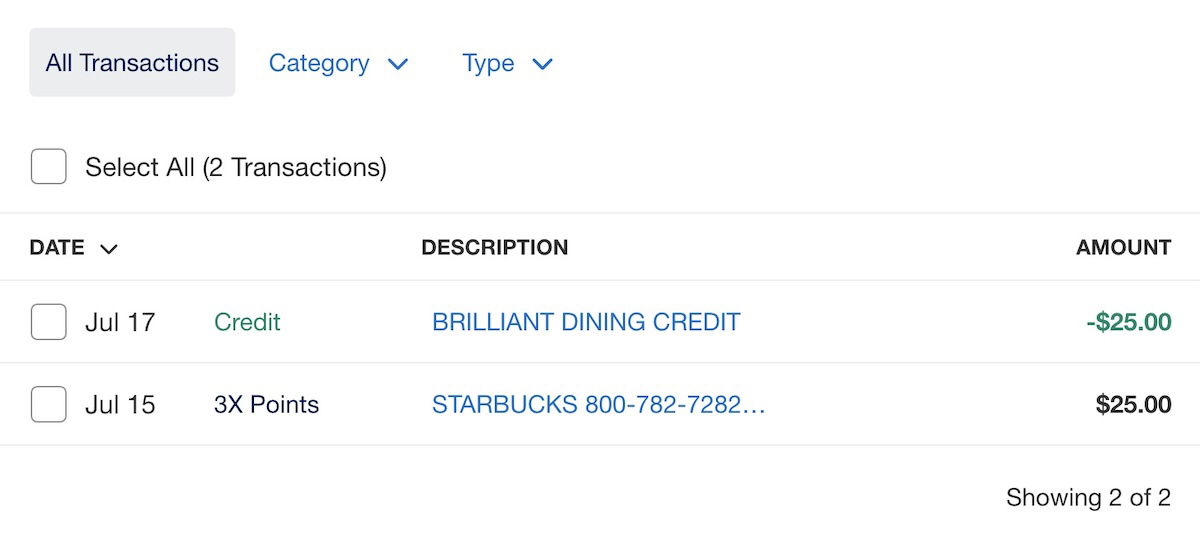

Instead, I load $25 into my Starbucks account every month through the Starbucks app, and then receive a regular credit for that amount a few days later. I imagine this would work similarly for other retailers in the restaurant category (depending on how they are categorized in their merchant agreement).

The way I see it, this card lets me spend $300 a year at Starbucks. While I’m not a huge Starbucks fan (there’s much better coffee out there), it always makes sense to stop at Starbucks on a road trip and my Starbucks balance never gets too high, so I guess it works out.

For me, this is one of the benefits that justifies the $650 annual card fee. I would consider the restaurant credit more or less face value, so the card actually “costs” me about $350 per year. Personally, I would pay $350 for the annual free night certificate alone (since it is valid at a hotel that costs up to 85,000 points), and the rest of the benefits are icing on the cake.

Conclusion

The Marriott Bonvoy Brilliant Card offers many valuable benefits, including a $300 annual dining credit. This is a monthly credit, so you can receive up to $25 on your statement each month to use toward a valid dining purchase worldwide.

Using the credit is easy, but for me the key is doing it without a huge opportunity cost. In my opinion, the easiest way is to top up your Starbucks balance by $25 each month so that you spend exactly as much as the balance. For me, this offsets the card’s annual fee by almost 50%.

What has been your experience using the Marriott Bonvoy Brilliant Card’s $300 dining credit?