The FTSE250 continues to rise as interest in UK equities increases generally, breaking through the 21,000 point mark for the first time this week, taking gains so far in 2024 to 8%.

The index is benefiting from improving economic news – and signs of greater political stability – from the UK. This is crucial as FTSE 250 stocks generate up to 60% of their gains in the UK.

But the improved trading conditions are only half the story. Demand for value stocks is also increasing worldwide. And the FTSE 250 is full of brilliant bargains after years of underperformance.

These are two of my favourites at the moment. City analysts expect their share prices to soar over the next 12 months, as I will explain.

The Renewables Infrastructure Group

Higher interest rates have created problems for utility companies, such as The Renewables Infrastructure Group (LSE:TRIG). This also applies to a combination of mild weather and high gas inventories, which have led to a decline in electricity prices.

These threats will remain in the future, but I believe that these threats are offset by the low price of this company.

Renewables Infrastructure Group shares are currently trading at 101.4 pence, a massive 21% discount to its estimated net asset value (NAV) of 125 pence per share.

Value investors can also look forward to a healthy dividend yield. This is around 7.2% and thus significantly above the FTSE 250 average of 3.2%.

I think the company could be a smart long-term investment if demand for green energy increases. Additionally, since the government has promised to relax planning regulations for wind farms, I think the company’s share price could rise sharply.

The City’s analysts are convinced of this. The seven analysts who have rated the company have set a price target of 121.6 pence for the Renewables Infrastructure Group shares over the next twelve months. This corresponds to a potential price gain of 20%.

NCC Group

Investing in technology stocks could be bumpy in the short term. With concerns about excessive valuations growing, there is a chance that share prices could collapse on both sides of the Atlantic. NCC Group(LSE:NCC) could see a significant reversal after recent strong price increases.

However, the cybersecurity expert doesn’t look particularly expensive at the moment. In fact, a price-to-earnings-growth (PEG) ratio of 0.5 suggests that the FTSE 250 company is actually quite cheap.

Any value below 1 indicates that a stock is undervalued.

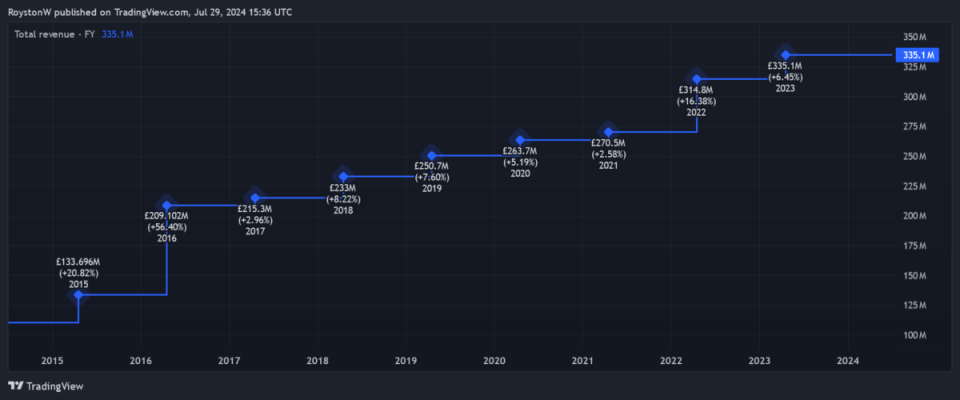

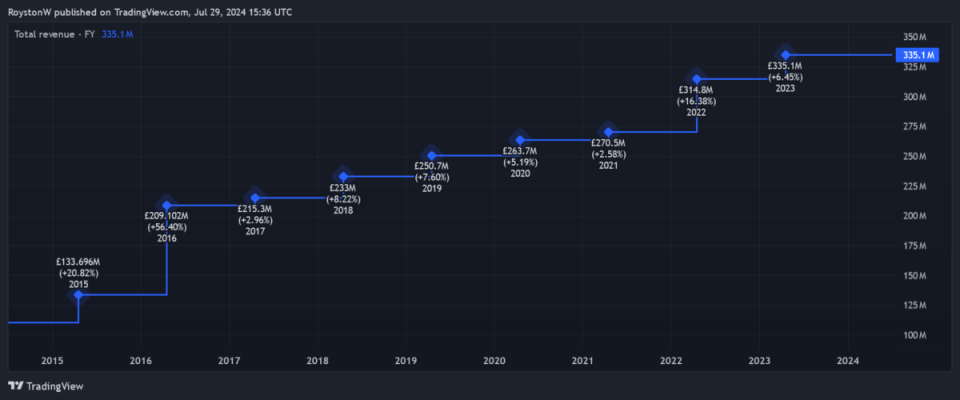

Artificial intelligence (AI) continues to make headlines in the technology world. But the fight against cyberattacks is also a product segment that still has enormous growth potential. The graph above shows how much NCC’s own sales have grown over the last decade.

Against this backdrop, analysts expect NCC’s share price to rise 15% from 148p over the next 12 months. The price target of 169.6p is based on the views of seven forecasters.

The post My 2 favourite cheap FTSE 250 stocks this August! first appeared on The Motley Fool UK.

Further reading

Royston Wild has shares in Renewables Infrastructure Group. The Motley Fool UK has no shares in the stocks mentioned. The views expressed in this article about the companies mentioned in this article are those of the author and as such may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool, we believe that considering a broad range of insights makes us better investors.

Motley Fool UK 2024