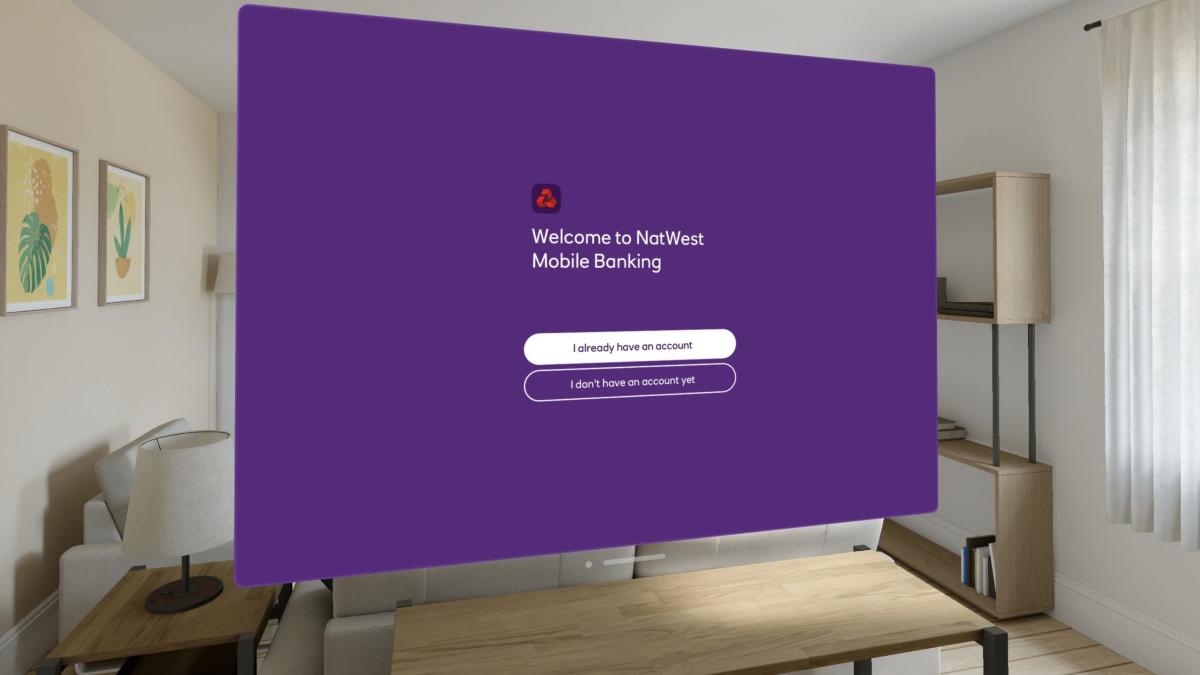

NatWest is making its banking app available on Apple’s Vision Pro headset, which blends the real world with digital content before the wearer’s eyes.

The bank said its retail banking app is available on Apple’s new device, allowing customers to access their daily banking transactions using spatial technology.

Retail customers of NatWest and its sister brands Royal Bank of Scotland and Ulster Bank can view their account balances, make transfers and manage direct debits in a “secure and comprehensive experience”.

Apple’s Vision Pro headset is essentially a wearable computer that overlays apps and other content on top of the real world. It retails for £3,499 and is controlled with the user’s eyes, hands and voice.

The device went on sale in the UK for the first time earlier this month and eager fans lined up outside Apple’s flagship store on Regent Street in London to get a first taste of the new technology.

Vision Pro offers more than 1,000 apps developed specifically for the device.

According to NatWest, users can visualize their financial world on a big screen while taking advantage of the bank’s existing app features, such as viewing credit scores, managing spending and accessing insights.

NatWest said this would make the bank one of the first banks in the world to have its app functionality based on Apple’s VisionOS operating system.

Using intuitive gestures, users can interact with apps by looking at them, tapping with their fingers to select them, scrolling with a flick of the wrist, or using a virtual keyboard or voice recorder to type.

NatWest said the company had made security changes to ensure customers were safe when banking on the new device.

The bank said it wanted to use the opportunity to further develop the new technology and gain insights into how customers could use spatial computing to visualise their finances in a more comprehensive format.

The company will use insights from app usage on the new device to improve its product and service design for digital features.

Customers can access NatWest’s digital assistant Cora, which uses generative AI for “a more intuitive, conversational customer experience,” the bank said.

NatWest’s banking app reached 10 million users in 2024.

Wendy Redshaw, Chief Digital Information Officer at NatWest Group, said: “It’s great to be at the forefront of such exciting new technology.

“We are delighted to now be able to offer our outstanding retail banking app in a comprehensive new experience.

“It will be interesting to gain insights and understand how customers use the app in this new technology to manage their finances and understand how we can create tailored offers to serve them even better.

“This is just a glimpse of what the future of banking might look like.”