Key findings

- Google Pay’s latest features showcase credit card benefits to maximize rewards.

- It now allows the “buy now, pay later” option for easier, deferred payments.

- Autocomplete in Google Pay makes it easy to enter credit card information using your face or fingerprint.

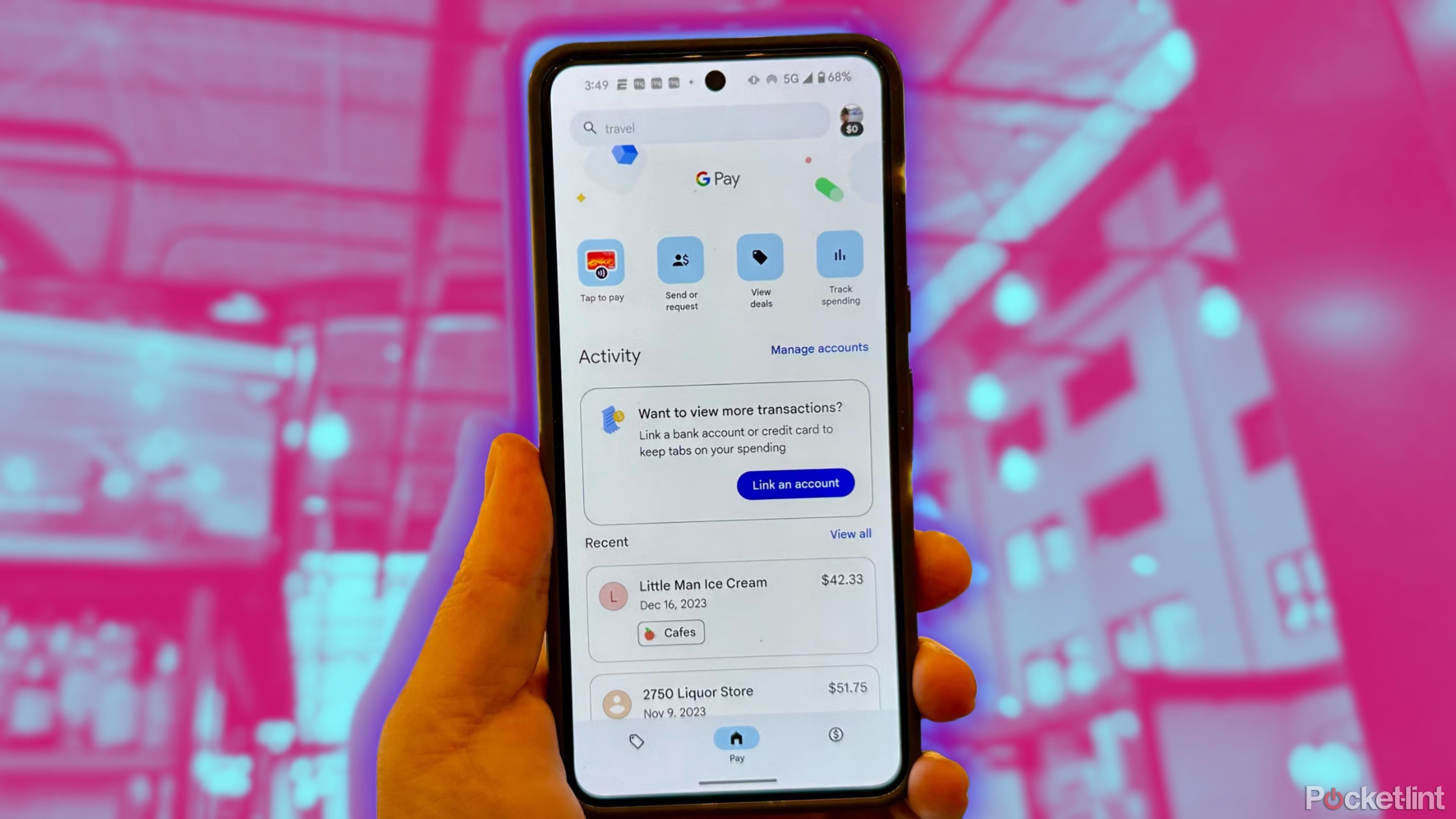

Mobile payments have become the standard way to make purchases for many businesses and people. The ability to make transactions without having a credit card, debit card, or cash handy has made it easier to go out. Paying for an ice cream cone by simply waving your phone in front of a terminal and then being able to go about your day eating your ice cream – instead of fumbling with change and trying to put bills back in your wallet while the ice cream cone melts away on you – is a much easier way to spend your day. Trust me, this happened to me recently, and I found myself wishing for mobile payments in that awkward moment.

Google had a promising time trying to push through a mobile payment method. Over the years they have used Google Pay, GPay, Android Pay, Google Wallet and more, making them all more complicated. There have been attempts to make things simpler and allow you to store your payment information in your Google Account making it easier to pay using your Android phone as well as your Google Chrome desktop browser. That’s where you’ve currently landed, as Google Pay exists and was recently updated, despite rumors that it would be discontinued.

Related

What is Google Wallet, how does it work and which banks support it?

Google Wallet is the company’s convenient payment system for Android users, formerly called Android Pay.

A few months ago, Google announced some new features for Google Pay to improve its usefulness. It can link your cards, protect your information, and make paying much smoother. Don’t worry about the ice melting on your hands because these new Google Pay features will help you do just that. Here’s what you can do with Google Pay now.

Google Pay

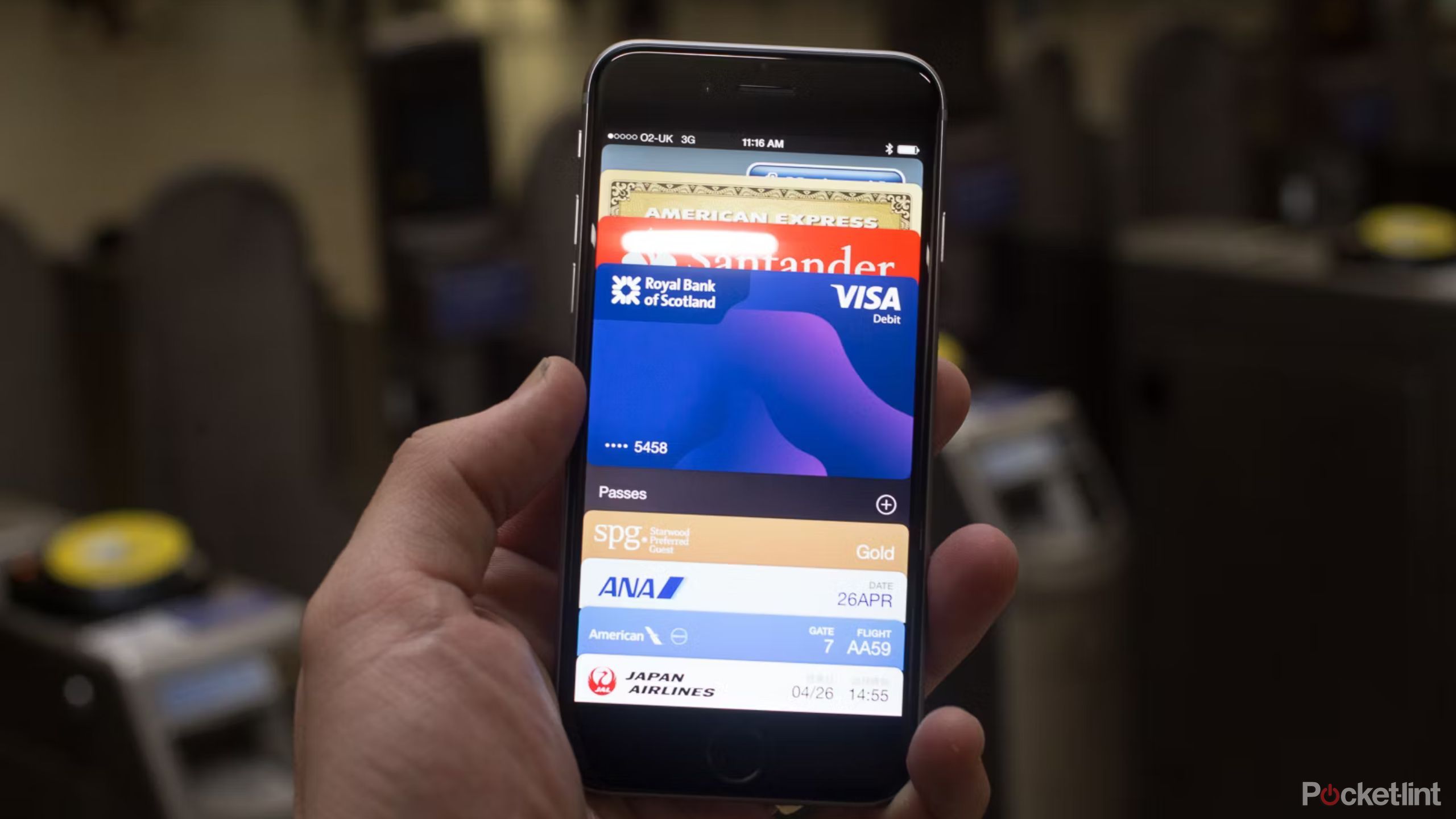

Google Pay is a way to make mobile payments on an Android device. You can sync your credit or debit card and pay wirelessly and securely with your phone.

What are the latest features of Google Pay

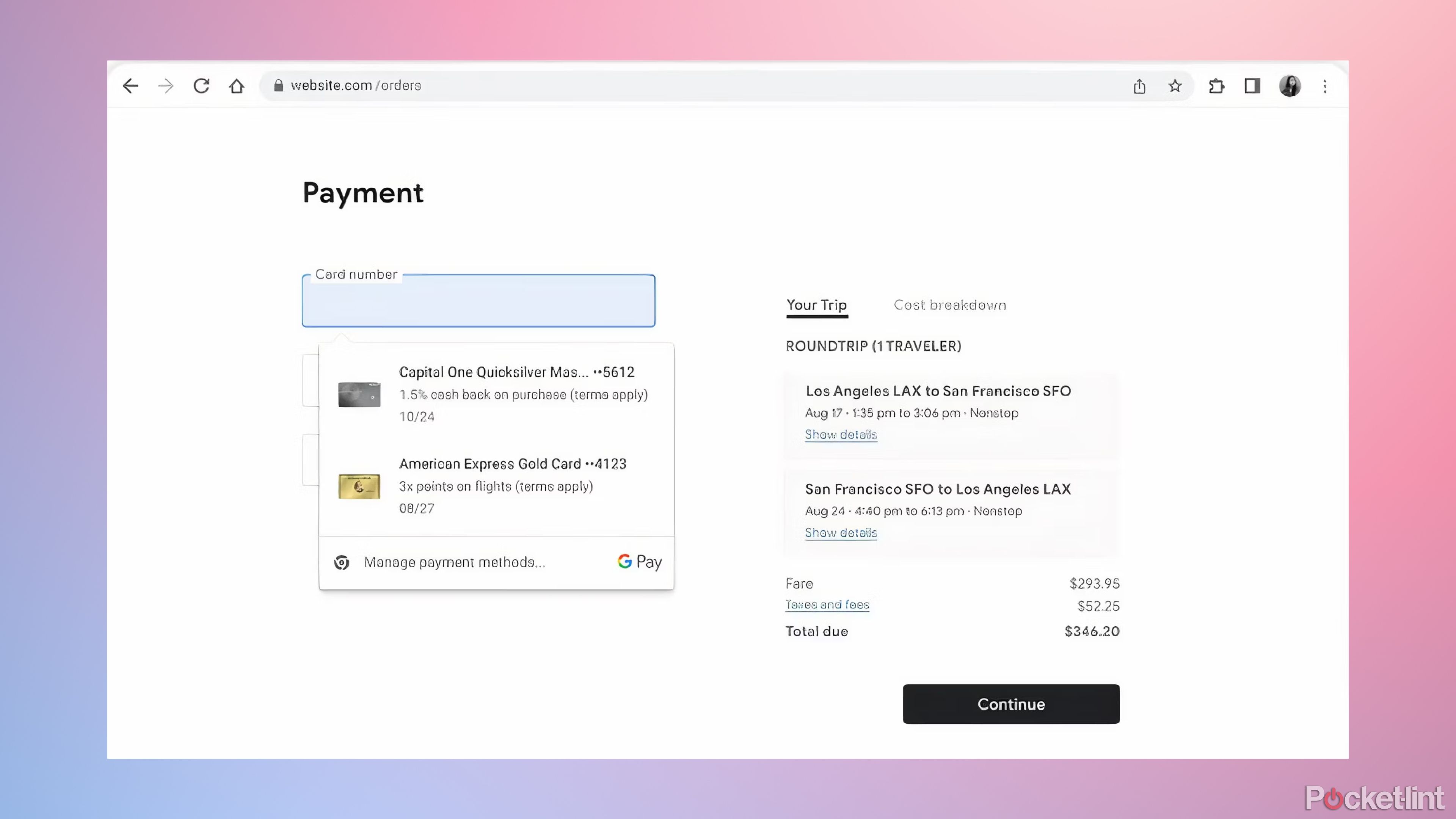

Show the benefits of your credit card

One of Google Pay’s newest features is being able to see what your credit card will offer you for a purchase. Different credit cards offer different rewards programs – maybe your credit card offers you 2% cash back on travel purchases or 4% on grocery purchases. If you use different credit cards for different purchases, Google Pay understands that and wants you to earn as many points or rewards as possible when you use the app.

There are plans to expand to other maps in the future.

With the latest update, you can save different cards and Google Pay will recognize your rewards when you make a purchase. When you’re on the purchase screen, you can look at your cards and see what rewards you would get if you chose that particular card for that particular purchase. This works for American Express and Capital One cardholders and the benefits are shown in the dropdown menu on the payment screen. There are plans to expand this to other cards in the future.

Related

How to turn your phone into a digital car key with Google Wallet

Digital car keys, similar to NFC credit cards, can be synced with your phone and car for convenient access

This works with both your Android phone and your Google Chrome desktop browser. You are not limited to purchasing certain types of items only on your phone or only on your computer.

More and more websites allow “buy now, pay later”

Google Pay is working with more locations on compatibility

Google / Pocket Lint

Many stores offer installment payments during the holiday season so customers can pay in more reasonable installments. The auto payment industry is supported by this mindset and many stores offer it for larger purchases these days. Google Pay recognizes this and works with many companies that offer the “buy now, pay later” option. Earlier this year, it began working with Affirm and Zip, two well-known companies that focus on these types of transactions.

Related

Why Samsung Pay and Google Pay may be coming to the iPhone

Apple has made significant commitments to ensure compliance with EU competition rules.

The extension has made it easier to shop online with Google Pay, either on your mobile device or in your desktop browser. The Android apps can either link to a shopper’s Affirm or Zip accounts or help them create a new account if they want to use the “buy now, pay later” feature, which appears in the payment menu during checkout if it’s offered for a specific purchase or by a specific site.

You can pay in installments through the website or link your Affirm or Zip account to pay in installments with them. Don’t worry, you can still pay everything at once if you want. If you don’t already have an Affirm or Zip account, you’ll need to sign up for one and complete an eligibility check to make sure you qualify for the buy now, pay later program.

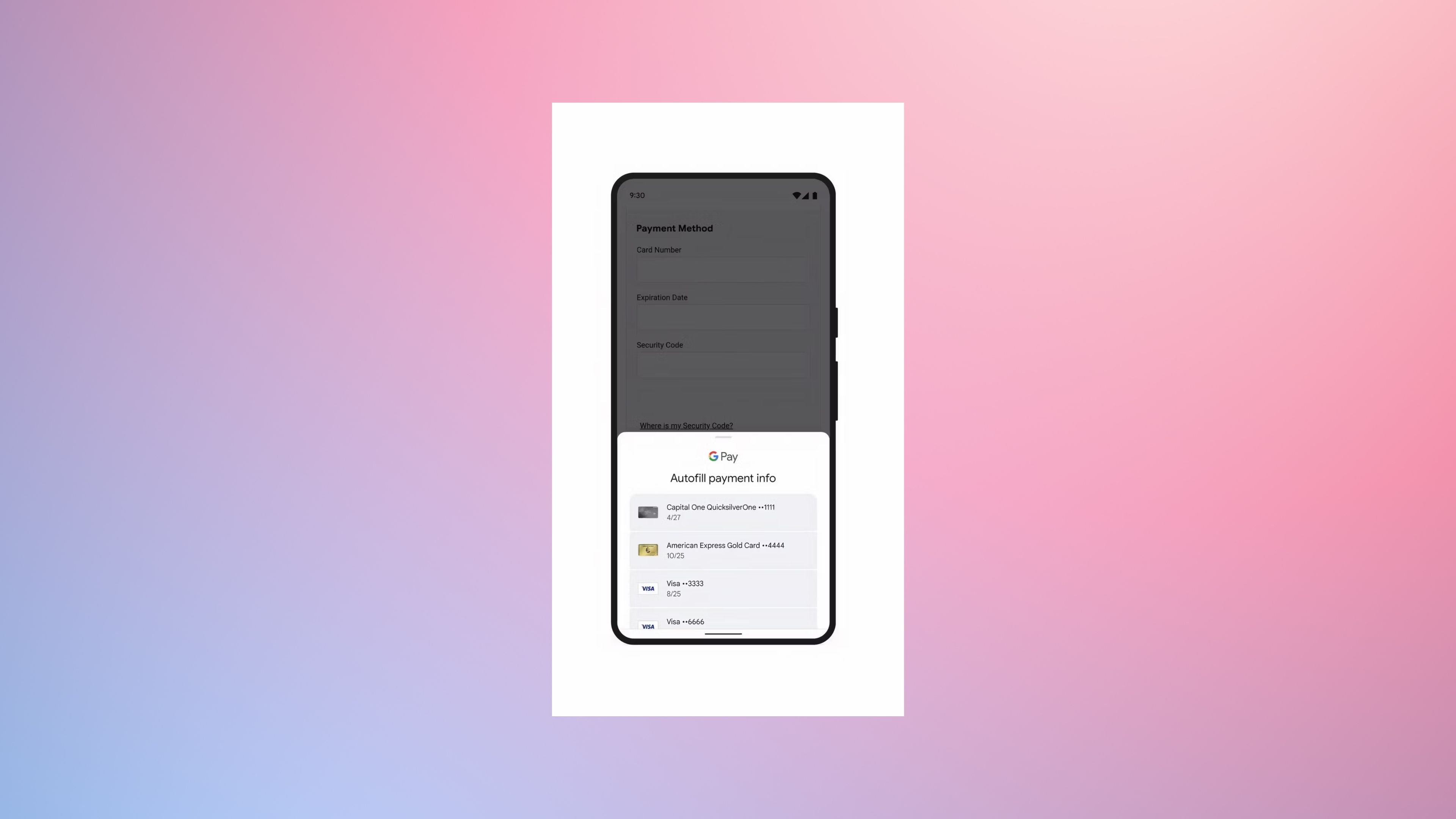

Use your fingerprint or face to view your credit card information

Do not enter it every time

Google / Pocket Lint

One of the most annoying aspects of paying with your mobile phone is having to enter your credit card details on all the different websites. With Google Pay’s latest feature, this is no longer a problem. You can view your credit card details on your Chrome or Android device using the “AutoFill” feature.

If you use Google Pay, you can select a product and then go to the payment menu. From there, you can automatically enter your credit card information in the same way you unlock your phone: with your face, fingerprint, or PIN code. You can choose which way you want to unlock auto-enter and use that to enter your credit card information.

Related

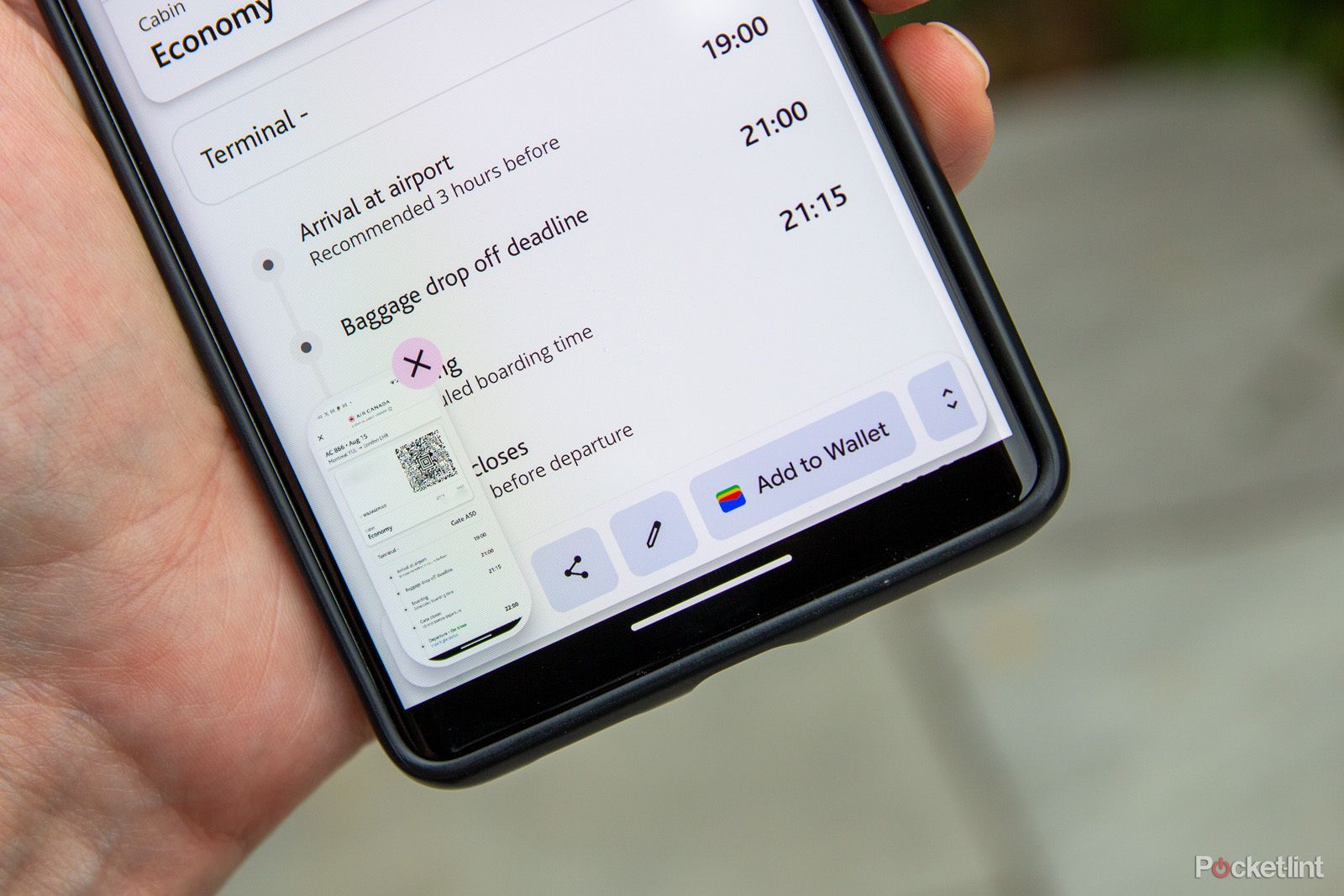

How to quickly add a boarding pass to Google Wallet with a screenshot

Anything you have a QR code for can be added to Google Wallet with a simple click. Here’s how.

You can also add an extra layer of security by unlocking your phone to use autofill, so if someone steals your phone while it’s open, they won’t be able to steal your credit card information without having to go through a second unlock process.