By purchasing an index fund, investors can achieve the average market return. However, if you buy good companies at attractive prices, the return on your portfolio can exceed the average market return. For example, the Novartis AG (VTX:NOVN) The share price has risen 12% over the past three years, comfortably outperforming the market decline of around 10% (excluding dividends). On the other hand, returns have not been quite as good recently, with shareholders gaining just 18%, including dividends.

Last week was a lucrative one for Novartis investors, so let’s see if fundamentals drove the company’s three-year performance.

Check out our latest analysis for Novartis

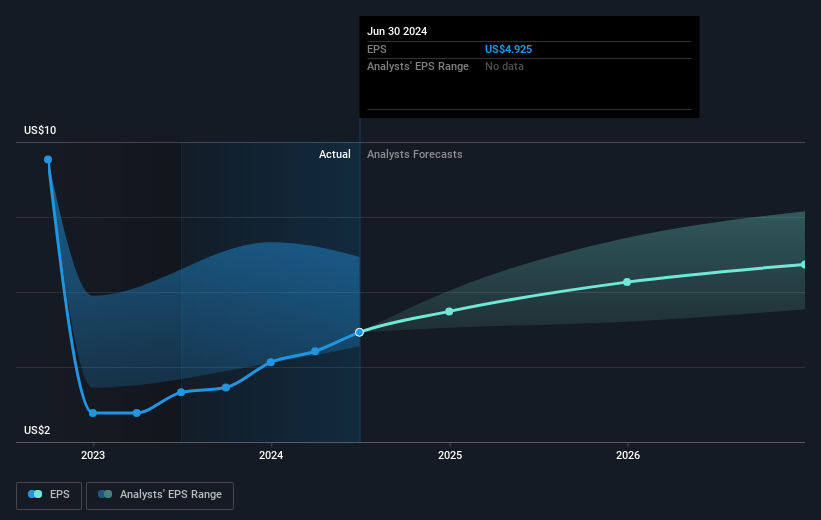

While markets are a powerful pricing mechanism, share prices reflect not only underlying business performance but also investor sentiment. A flawed but useful way to assess how sentiment toward a company has changed is to compare earnings per share (EPS) to the share price.

During the three years of the share price run, Novartis achieved an average earnings per share growth of 7.8% per year. The average annual share price increase of 4% is actually lower than the EPS growth, so one could reasonably conclude that the market for the stock has cooled off.

The company’s earnings per share (over time) is shown in the image below (click to see the exact numbers).

We know that Novartis has been improving its bottom line recently, but will the company also increase its revenue? If you’re interested, you can read about it here. free Report with consensus forecasts for sales.

What about dividends?

It’s important to consider both the total shareholder return and the share price return for any stock. While the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. In the case of Novartis, the TSR was 33% over the last three years. That exceeds the share price return we mentioned earlier. And there’s no prize for guessing that the dividend payments largely explain the divergence!

A different perspective

It’s nice to see that Novartis shareholders have received a total return of 18% over the last year. That includes the dividend. That’s better than the 7% annualized return over half a decade, meaning the company has been doing better recently. With momentum in the share price still strong, it might be worth taking a closer look at the stock so you don’t miss out on an opportunity. While it’s worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Think about risks, for example. Every company has them, and we’ve found 2 warning signals for Novartis You should know about this.

If you like buying stocks along with management, you might like this free List of companies. (Note: many of them go unnoticed AND have an attractive valuation).

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks currently trading on Swiss exchanges.

Valuation is complex, but we are here to simplify it.

Find out if Novartis is undervalued or overvalued with our detailed analysis. Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.