RE/MAX Holdings, Inc. (NYSE:RMAX) shares have continued their recent run, gaining 25% in the last month alone. Not all shareholders will be cheering, as the stock price is still down a very disappointing 30% over the last twelve months.

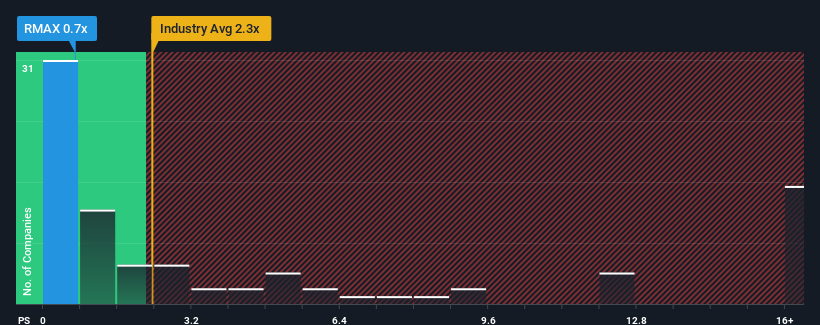

Despite the significant price increase, RE/MAX Holdings’ price-to-sales (or “P/S”) ratio of 0.7 may still be sending buy signals right now, considering that nearly half of all companies in the real estate industry in the United States have a P/S ratio of over 2.3x, and even P/S ratios above 9x are not uncommon. However, the P/S could be low for a reason, and further research is needed to determine if it is justified.

Check out our latest analysis for RE/MAX Holdings

What is RE/MAX Holdings’ recent performance?

While the industry has seen revenue growth recently, RE/MAX Holdings’ revenue has gone into reverse, which is not good. The P/S ratio is probably low because investors think this poor revenue performance will not improve. So, you could say the stock is cheap, but investors will look for improvement before they consider it a good value.

Would you like to know how analysts assess the future of RE/MAX Holdings compared to the industry? In this case free Report is a good starting point.

Do the sales forecasts match the low P/S ratio?

RE/MAX Holdings’ price-to-earnings ratio would be typical of a company that is expected to have limited growth and, more importantly, is underperforming the industry.

First, if we look back, the company’s revenue growth last year was not exactly exciting as it recorded a disappointing decline of 7.0%. Nevertheless, overall, revenue was up a good 7.3% year-on-year thanks to the earlier growth phase. So, first, we can say that the company has generally done a good job of growing revenue during this time, even if there have been some hiccups along the way.

Looking ahead, estimates from the seven analysts covering the company suggest that revenue growth will turn negative next year, declining by 0.9%. This is a disappointing result considering the 16% growth rates forecast for the industry.

Given this information, we are not surprised to see RE/MAX Holdings trading at a lower P/E than the industry. Still, there is no guarantee that the P/E has already bottomed out as revenues are declining. There is a possibility that the P/E could fall to even lower levels if the company fails to improve its revenue growth.

The conclusion on the P/S of RE/MAX Holdings

The recent price increase has not been enough to bring RE/MAX Holdings’ price-to-sales ratio close to the industry average. Normally, we would caution against reading too much into the price-to-sales ratio when making investment decisions, although it can say a lot about what other market participants think of the company.

Given the weaker revenue outlook compared to the rest of the industry, it’s no surprise that RE/MAX Holdings’ P/S ratio is at the lower end of the scale. At this point, investors believe the potential for revenue growth is not large enough to justify a higher P/S ratio. Under these circumstances, it’s hard to imagine the stock price rising much in the near future.

Before you form an opinion, we found out 3 warning signs for RE/MAX Holdings (2 cannot be ignored!) that you should know.

If you like strong, profitable companies, then you should check this out free List of interesting companies that trade at a low P/E ratio (but have proven that they can grow their earnings).

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.