Unfortunately for some shareholders Rent the Runway, Inc. (NASDAQ:RENT) has fallen 28% over the past 30 days, extending recent losses. For all long-term shareholders, last month caps off a year to forget as the share price fell 56%.

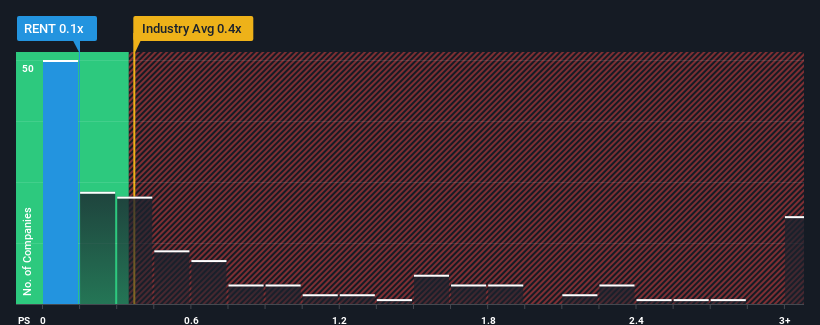

Although the price has dropped significantly, one might be indifferent to Rent the Runway’s P/S ratio of 0.1, since the median price-to-sales (or “P/S”) ratio among specialty retailers in the United States is also 0.4. However, investors might miss a clear opportunity or potential pullback if there is no rational basis for the P/S.

Check out our latest analysis for Rent the Runway

How Rent the Runway developed

While the industry has seen revenue growth recently, Rent the Runway’s revenue has gone into reverse, which is not good. One possibility is that the P/S ratio is modest because investors believe this poor revenue trend will change. However, if it doesn’t, investors could be falling into a trap and overpaying for the stock.

Want to know how analysts see Rent the Runway’s future compared to the industry? In this case, our free Report is a good starting point.

Do the sales forecasts match the P/S ratio?

There is a general assumption that a company should be in line with the industry average for P/S ratios like Rent the Runway’s to be considered reasonable.

First, if we look back, the company’s revenue growth last year wasn’t exactly exciting, as it posted a disappointing 1.5% decline. Despite this, overall revenue has increased by an admirable 104% year-on-year, regardless of the last 12 months. So, first, we can say that the company has generally done a very good job of growing revenue during this time, even if there have been some hiccups along the way.

As for the outlook, the three analysts who cover the company estimate that next year will bring growth of 4.1%, which is roughly in line with the 3.6% growth forecast for the industry as a whole.

With that in mind, it’s understandable that Rent the Runway’s earnings/loss is in line with most other companies. It seems shareholders are content to just hold on while the company keeps a low profile.

What can we learn from Rent the Runway’s P/S?

After Rent the Runway’s share price plunge, the price-to-sales ratio is barely clinging to the industry average. Generally, we prefer to use the price-to-sales ratio only to determine what the market thinks about the overall health of a company.

Our look at Rent the Runway’s revenue growth estimates shows that the P/S ratio is roughly in line with our expectations, as both metrics are closely aligned with industry averages. At this point, investors believe that the potential for revenue improvement or deterioration is not large enough to drive the P/S ratio up or down. All in all, it’s hard to imagine the stock price moving much in one direction or the other in the near future unless there are major shocks to the P/S and revenue estimates.

Please note, however, Rent the Runway shows 6 warning signs in our investment analysis, and 3 of them cannot be ignored.

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.