When we invest, we generally look for stocks that outperform the market average. Buying undervalued companies is one way to achieve excess returns. For example, the Fujitsu Life Sciences Co., Ltd. (TSE:6516) The share price has risen 83% over the past 5 years, comfortably outperforming the market return of around 69% (excluding dividends). However, recent returns have not been as impressive. Last year, the stock returned just 11% including dividends.

With the stock’s market cap up JPY7.3 billion in the past week alone, let’s see if the underlying performance has driven the long-term returns.

Check out our latest analysis for Sanyo Denki

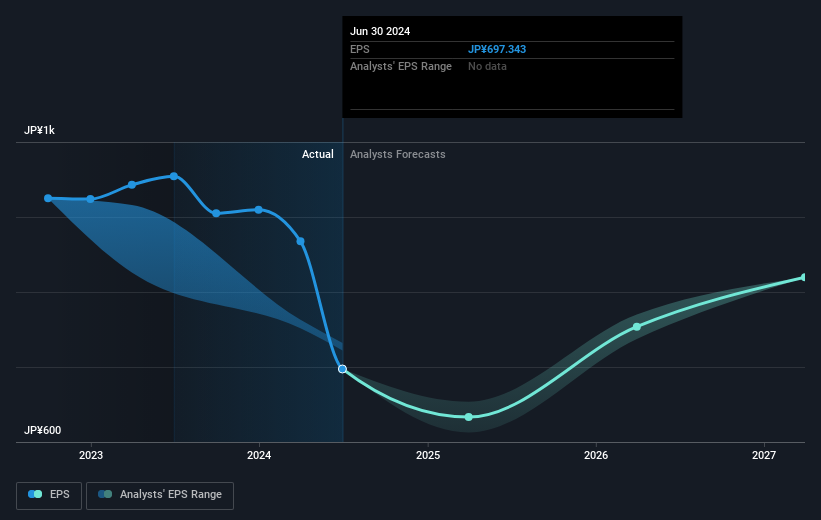

While the efficient markets hypothesis is still taught by some, it is well established that markets are over-reactive dynamic systems and investors do not always act rationally. A flawed but useful way to assess how sentiment toward a company has changed is to compare earnings per share (EPS) to the share price.

During the five years of the stock price, Sanyo Denki achieved a compounded earnings per share (EPS) growth of 26% per year. This EPS growth is higher than the average annual increase in the stock price of 13%. Therefore, the market seems to have become relatively pessimistic about the company. The relatively low P/E ratio of 10.93 also indicates market fears.

The following graph shows how EPS has changed over time (the exact values can be viewed by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of the historical growth trends. You can find them here.

What about dividends?

When considering investment returns, the difference must be taken into account between Total return for shareholders (TSR) and Share price return. The TSR is a return calculation that takes into account the value of cash dividends (assuming that all dividends received were reinvested) and the calculated value of any discounted capital raisings and spin-offs. The TSR arguably gives a more comprehensive picture of the return generated by a stock. In the case of Sanyo Denki, the TSR over the last 5 years is 103%. This exceeds the share price return mentioned previously. The dividends paid by the company have therefore in total shareholder return.

A different perspective

Sanyo Denki shareholders have gained 11% for the year (even including dividends). Unfortunately, this is below the market return. It’s probably a good sign that the company can do even better in the long term, having given shareholders an annual TSR of 15% over five years. It’s quite possible that the company could continue to do well even if share price gains slow down. While it’s worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we’ve found that: 1 warning signal for Sanyo Denki that you should know.

If you would rather check out another company — one with potentially better financials — then don’t miss this free List of companies that have proven their ability to increase their earnings.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.