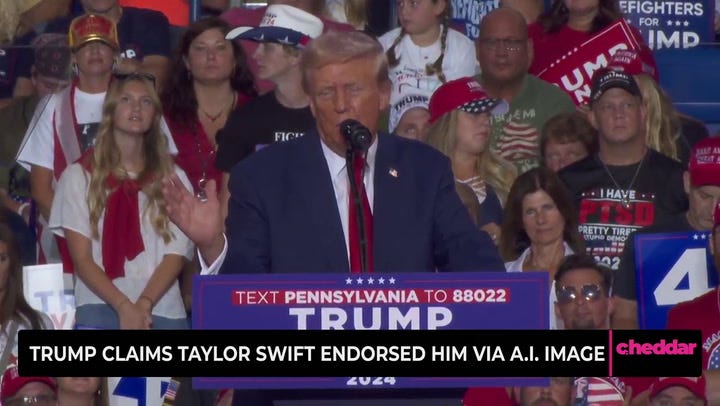

Trump claims Taylor Swift endorsed him by reposting AI image

Did Taylor Swift really endorse Trump for president? Donald Trump reposted a post about artificial intelligence during his re-election campaign for the White House.

Cheddar

Share prices of the parent company of Donald Trump’s social media platform Truth Social reached a new low on the first day of the Democratic Party Convention.

Trump Media & Technology Group closed at $22.24 on Monday, down 3.56% from its previous close and its lowest close since the company went public in March. Its last lowest close was $22.84 on April 16, the second day of Trump’s New York criminal trial, where a jury found him guilty on 34 counts of falsifying business records.

Trump Media, which trades under the ticker symbol DJT, has seen its share price fall almost steadily since mid-July. The new low comes at a time when the Trump campaign is struggling to gain traction against the new Democratic candidate, Vice President Kamala Harris. Earlier this month, the company reported losses of more than $16 million and revenue of less than $1 million in its second fiscal quarter.

Trump Media did not immediately respond to USA TODAY’s request for comment.

“He’s just an old guy”: Generation Z Democrats laugh at the AI drama between Donald Trump and Taylor Swift

Trump Media share price

Trump Media Compares to a Meme Stock in Terms of Volatility and Overvaluation

Trump Media has long been compared to a meme stock because experts say its prices rise and fall largely based on the coordination and attention of retail investors.

The company was founded in 2021 after Trump was banned from other social media companies following the Jan. 6 riot at the U.S. Capitol. The company went public in March through a merger with shell company Digital World Acquisition Corp., a special purpose acquisition company (SPAC). Despite a spectacular debut, share prices have risen sharply, often in line with the rollercoaster news cycle for Trump this year.

Experts also said the stock was overvalued by conventional Wall Street standards compared to other social media companies.

In May, Trump Media reported a net loss of $327.6 million and revenue of $770,500 in the first quarter of 2024, according to a filing. In August, the company reported losses of more than $16 million and revenue of less than $1 million in the second fiscal quarter. Regulatory filings show the company was loss-making in 2023, making about $4 million in revenue and losing more than $58 million.