Shougang Fushan Resources Group Limited (HKG:639) Shareholders might be concerned after the share price fell 15% in the last quarter. On the positive side, returns have been quite good over the last half decade. The 69% return has definitely outperformed the market return!

With the stock’s market cap increasing by HK$493 million in the past week alone, let’s see if the underlying performance has driven the long-term returns.

View our latest analysis for Shougang Fushan Resources Group

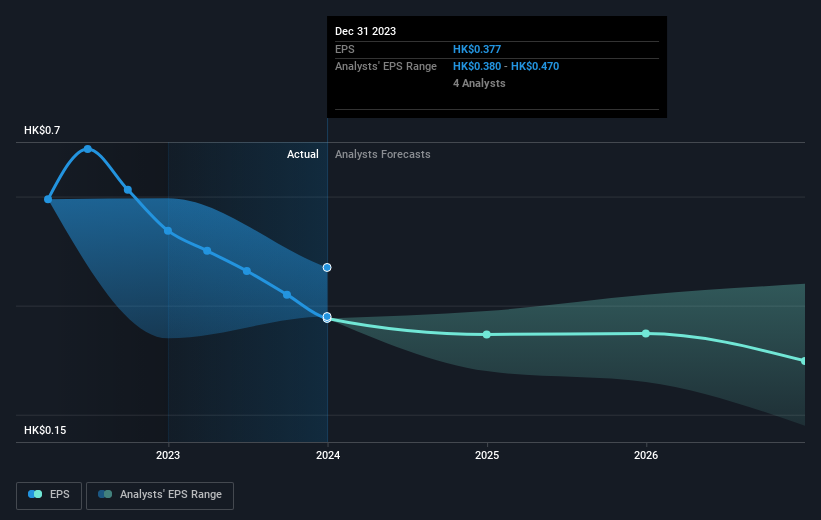

There’s no denying that markets are sometimes efficient, but prices don’t always reflect underlying company performance. By comparing earnings per share (EPS) and share price changes over time, we can get a sense of how investor attitudes toward a company have changed over time.

During the five years of share price growth, Shougang Fushan Resources Group achieved a compounded earnings per share (EPS) growth of 13% per year. This EPS growth is quite close to the average annual share price increase of 11%. This suggests that investor sentiment toward the company has not changed much. In fact, it seems as though the share price is reacting to the EPS.

You can see how earnings per share have changed over time in the image below (click on the chart to see the exact values).

We’re happy to report that the CEO is compensated more modestly than most CEOs at similarly capitalized companies. It’s always worth keeping an eye on CEO salaries, but a more important question is whether the company will grow its earnings over the years. Before buying or selling a stock, we always recommend a close examination of historical growth trends, which you can find here.

What about dividends?

It is important to consider the total return to shareholders, as well as the share price return for each share. The TSR is a return calculation that takes into account the value of cash dividends (assuming that any dividends received were reinvested) and the calculated value of any discounted capital raisings and spin-offs. So, for companies that pay a generous dividend, the TSR is often much higher than the share price return. We note that the TSR for Shougang Fushan Resources Group over the last 5 years was 208%, which is better than the share price return mentioned above. The dividends paid by the company have thus in total shareholder return.

A different perspective

It’s nice to see that Shougang Fushan Resources Group has rewarded shareholders with a total return of 39% over the last twelve months. This includes the dividend. Given that the one-year TSR is better than the five-year TSR (the latter is 25% per year), it seems that the stock’s performance has improved recently. With the share price momentum still strong, it might be worth taking a closer look at the stock so you don’t miss out on an opportunity. I find it very interesting to look at the share price over the long term as an indicator of company performance. But to really gain insight, we need to consider other information as well. For example, we’ve identified: 2 warning signs for Shougang Fushan Resources Group (1 is concerning) that you should be aware of.

We’ll like Shougang Fushan Resources Group better if we see some big insider buying. While we wait, check out this free List of undervalued stocks (mostly small caps) with significant recent insider purchases.

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.