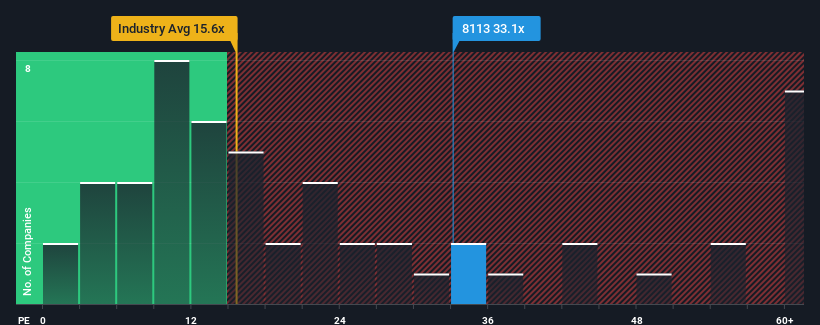

The (TSE:8113) price-to-earnings (or “P/E”) ratio of 33.1 might make it seem like a strong sell right now, compared to the market in Japan, where about half of the companies have P/E ratios below 13x, and even P/E ratios below 9x are quite common. Still, we would have to dig a little deeper to determine if there is a rational basis for the greatly elevated P/E ratio.

Unicharm has certainly done a good job of growing its earnings more than most companies recently. The P/E ratio is probably so high because investors expect this strong earnings performance to continue. You’d better hope so, otherwise you’re paying a pretty high price for no particular reason.

Check out our latest analysis for Unicharm

Would you like to know how analysts assess the future of Unicharm compared to the industry? In this case, our free Report is a good starting point.

Is there enough growth for Unicharm?

To justify its P/E ratio, Unicharm would need to deliver outstanding growth that significantly outperformed the market.

If we look at the earnings growth over the past year, the company has seen a fantastic 30% increase. There has also been a 27% overall increase in earnings per share over the past three-year period, which has been largely helped by short-term performance. Therefore, it is fair to say that the company’s earnings growth has been remarkable lately.

As for the outlook, growth of 9.2% per year is expected over the next three years, according to estimates from the ten analysts covering the company. The rest of the market is forecast to grow at 9.3% per year, which is not much different.

Given this information, we find it interesting that Unicharm is trading at a high P/E relative to the market. It appears that many investors in the company are more optimistic than analysts indicate and are not willing to offload their shares at this time. However, additional gains will be hard to come by as this level of earnings growth will likely weigh on the share price eventually.

The last word

We usually caution against reading too much into the price-earnings ratio when making investment decisions, even though it can say a lot about what other market participants think about the company.

Our study of Unicharm’s analyst forecasts found that the market-like earnings outlook does not affect the high P/E as much as we would have expected. When we see an average earnings outlook with market-like growth, we suspect the share price could decline, driving the high P/E down. Unless these conditions improve, it is difficult to accept these prices as reasonable.

Many other important risk factors can be found in the company’s balance sheet. Take a look at our free Balance sheet analysis for Unicharm with six simple checks of some of these key factors.

You may find a better investment than Unicharm. If you want a selection of possible candidates, check out this free List of interesting companies that trade at a low P/E ratio (but have proven that they can grow their earnings).

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own metric from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.