It could be worrying for shareholders to see T&D Holdings, Inc. (TSE:8795) The share price has fallen 20% in the last month. However, that does not take away from the really solid long-term returns the company has generated over the last five years. In fact, the share price has risen an impressive 130% in that time. For some, the recent decline would come as no surprise after such a rapid rise. Ultimately, business performance will determine whether the share price continues the positive long-term trend.

Last week was a lucrative one for T&D Holdings investors, so let’s see if fundamentals drove the company’s five-year performance.

Check out our latest analysis for T&D Holdings

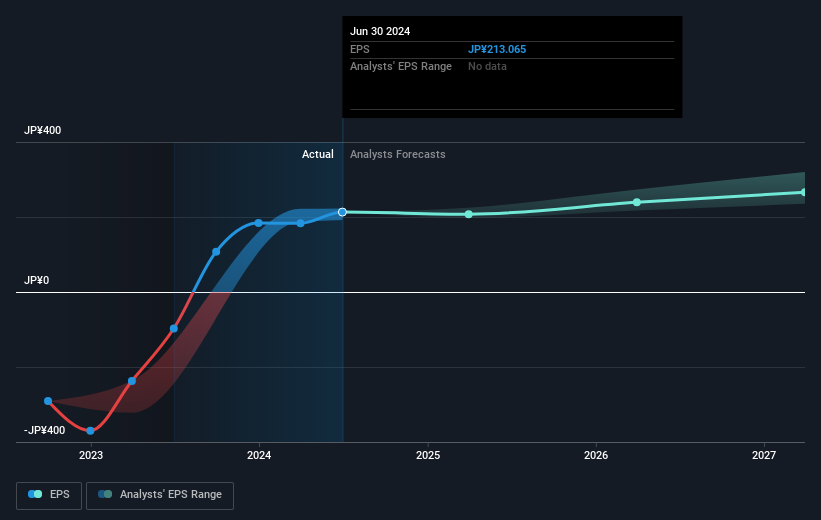

To quote Buffett, “Ships will sail around the world, but the Flat Earth Society will flourish. There will continue to be huge discrepancies between price and value in the marketplace…” A flawed but reasonable way to assess how sentiment toward a company has changed is to compare earnings per share (EPS) to the share price.

During the five years of share price growth, T&D Holdings was able to go from losses to profitability. Sometimes the start of profitability is an important turning point that can herald rapid earnings growth, which in turn justifies very strong share price gains.

The company’s earnings per share (over time) is shown in the image below (click to see the exact numbers).

We know that T&D Holdings has been improving its bottom line recently, but will it also grow its revenue? If you’re interested, you can read about it here. free Report with consensus forecasts for sales.

What about dividends?

It is important to consider the total shareholder return as well as the share price return for any given stock. The TSR includes the value of any spin-offs or discounted capital raisings, as well as any dividends, based on the assumption that the dividends are reinvested. It is fair to say that the TSR gives a more complete picture for dividend paying stocks. We note that the TSR for T&D Holdings over the last 5 years was 176%, which is better than the share price return mentioned above. So the dividends paid by the company have in total shareholder return.

A different perspective

T&D Holdings shareholders received a total return of 6.6% over the year. Unfortunately, this is below the market return. If we look back over the last five years, the returns are even better, coming in at 23% per year for five years. It could well be that this company is worth keeping an eye on, given the sustained positive reception it has received from the market over time. I find it very interesting to look at the share price over the long term as an indicator of company performance. But to really gain insight, we need to consider other information as well. For example, we have identified: 1 warning signal for T&D Holdings that you should know.

But please note: T&D Holdings may not be the best stock to buySo take a look at the free List of interesting companies with past earnings growth (and further growth forecast).

Please note that the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we are here to simplify it.

Discover whether T&D Holdings could be under- or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.