Matrix Holdings Limited (HKG:1005) shareholders would be happy to hear that the share price had a great month, gaining 127% and recovering from previous weakness. However, the 30-day gain does not change the fact that longer-term shareholders have seen their shares decimated by the 54% share price decline over the past twelve months.

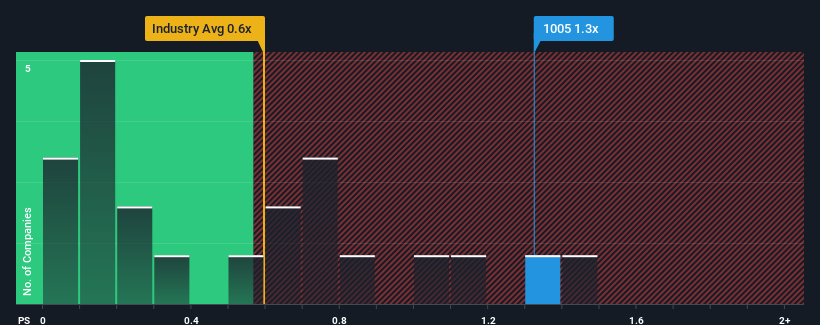

Since the price has skyrocketed while nearly half of the companies in Hong Kong’s leisure industry have a price-to-sales ratio (or “P/S”) of under 0.6x, you might consider Matrix Holdings, with its P/S ratio of 1.3x, a stock that’s probably not worth researching. However, the P/S could be high for a reason and further research is needed to determine if it’s justified.

View our latest analysis for Matrix Holdings

How has Matrix Holdings performed recently?

For example, let’s say Matrix Holdings’ financial performance has been poor recently as revenue has been declining. One possibility is that the P/S ratio is high because investors believe the company will still do enough to outperform the broader industry in the near future. If not, existing shareholders may be quite nervous about the profitability of the share price.

Although there are no analyst estimates for Matrix Holdings, take a look at these free Data-rich visualization to see how the company is performing in terms of profit, revenue and cash flow.

Is sufficient sales growth forecast for Matrix Holdings?

There is a fundamental assumption that a company must outperform its industry for P/S ratios like Matrix Holdings’ to be considered reasonable.

When we reviewed last year’s financials, we were disappointed to see that the company’s revenues fell by 28%. This means that revenues have also declined over the long term, with revenues declining by 21% overall over the last three years. Accordingly, shareholders were disappointed with the medium-term revenue growth rates.

If you compare this medium-term sales development with the one-year forecast for the entire industry, which assumes growth of 12%, this is not a good prospect.

With this in mind, we find it troubling that Matrix Holdings’ P/S exceeds that of its industry peers. Clearly, many investors in the company are much more optimistic than its recent history would suggest, and are unwilling to dump their shares at any price. Only the bravest would assume that these prices are sustainable, as a continuation of recent revenue trends will likely ultimately weigh heavily on the share price.

The last word

The sharp rise in Matrix Holdings shares has caused the company’s price-to-sales ratio to increase significantly. We would say that the price-to-sales ratio is not primarily used as a valuation tool, but rather to gauge current investor sentiment and future expectations.

We have noted that Matrix Holdings is currently trading at a significantly higher than expected price-to-earnings ratio, given that revenues have been declining over the medium term recently. When we see revenues declining and below industry forecasts, we believe the possibility of a share price decline is very real, bringing the price-to-earnings ratio back into the realm of reason. If recent medium-term revenue trends continue, shareholders’ investments will be put at significant risk and potential investors will be at risk of paying an inflated premium.

You should always think about the risks. A typical example: We have 3 warning signs for Matrix Holdings You should be aware.

If you like strong, profitable companies, then you should check this out free List of interesting companies that trade at a low P/E ratio (but have proven that they can grow their earnings).

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.