Despite an already strong run, Ta Liang Technology Co., Ltd. (TWSE:3167) shares have surged over the past 30 days, gaining 31%, with the past month capping off a massive 137% rise over the past year.

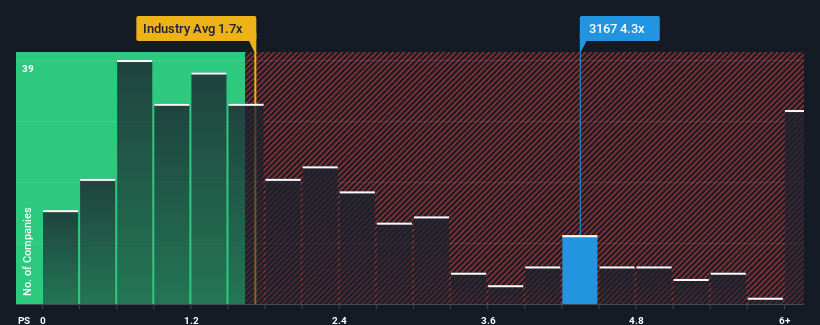

With the price up sharply and about half of the companies in Taiwan’s electronics industry having a price-to-sales (or “P/S”) ratio of less than 1.7, you might want to consider Ta Liang Technology, with its P/S ratio of 4.3, as a stock to avoid altogether. Still, we’d have to dig a little deeper to determine if there’s a rational basis for the sharply elevated P/S.

Check out our latest analysis for Ta Liang Technology

What does Ta Liang Technology’s P/S mean for shareholders?

Ta Liang Technology has been doing a good job of growing its revenue at a solid pace recently. Many expect its respectable revenue performance to outperform most other companies in the coming period, which has increased investors’ willingness to pay for the stock. One would really hope so, otherwise you’re paying a pretty high price for no particular reason.

Although there are no analyst estimates for Ta Liang Technology, take a look at these free Data-rich visualization to see how the company is performing in terms of profit, revenue and cash flow.

Do the sales forecasts correspond to the high P/S ratio?

To justify its P/S ratio, Ta Liang Technology would have to deliver outstanding growth that significantly exceeds the industry growth.

Looking back, last year saw the company achieve an exceptional 16% increase in revenue. Despite this strong recent growth, the company is still struggling to catch up, with its revenue frustratingly shrinking by 56% over the last three years. Accordingly, shareholders were disappointed with medium-term revenue growth rates.

In contrast to the group, the rest of the industry is expected to grow by 19% next year, which puts the company’s recent medium-term sales decline into perspective.

With this in mind, it is alarming that Ta Liang Technology’s price-to-earnings ratio is higher than most other companies. It seems that many investors in the company are much more optimistic than the recent past would suggest, and are not willing to offload their shares at any price. There is a very good chance that existing shareholders are setting themselves up for future disappointment if the price-to-earnings ratio falls to levels more in line with recent negative growth rates.

What does Ta Liang Technology’s P/S mean for investors?

Ta Liang Technology shares have been on a strong upward trend recently, which has really helped its P/S ratio. While the price-to-sales ratio shouldn’t be the deciding factor in whether or not you buy a stock, it is a perfectly viable indicator of sales expectations.

Our research into Ta Liang Technology found that declining revenue over the medium term is not leading to a P/S ratio as low as expected, as the industry is geared towards growth. If we see revenue declining and falling short of industry forecasts, we think a share price decline is very likely, which would bring the P/S ratio back into the realm of reasonableness. If recent medium-term revenue trends continue, it would pose a significant risk to existing shareholders’ investments and prospective investors would have a hard time accepting the stock’s current value.

Before you form an opinion, we found out 3 warning signs for Ta Liang Technology (2 cannot be ignored!) that you should know.

If you are looking for companies with solid earnings growth in the pastyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we are here to simplify it.

Find out if Ta Liang Technology could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.