Sun Corporation (TSE:6736) shares have continued their recent momentum, gaining 32% in the last month alone. The year-to-date gain is now 206% following the latest advance, which has investors taking notice.

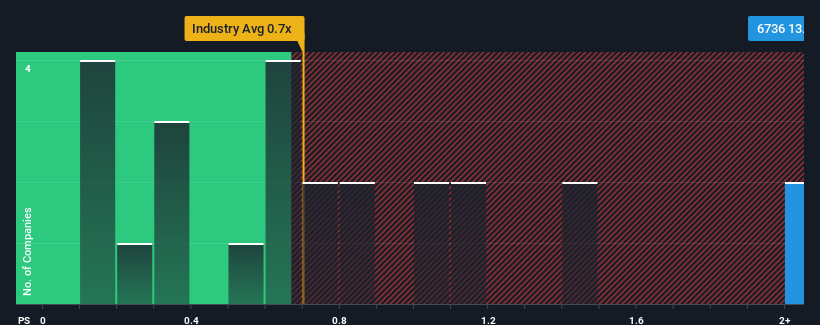

Since the price has skyrocketed while nearly half of the companies in Japan’s technology industry have a price-to-sales ratio (or “P/S”) of under 0.7x, Sun, with its P/S ratio of 13.1x, could be considered a stock not worth researching. However, the P/S could be quite high for a reason and further research is needed to determine if it is justified.

Check out our latest analysis for Sun

What does Sun’s P/S mean for shareholders?

For example, Sun’s revenues have been declining over the past year, which is far from ideal. One possibility is that the price-to-earnings ratio is high because investors believe the company will still do enough in the near future to outperform the industry as a whole. If not, existing shareholders may be quite nervous about the profitability of the stock price.

We don’t have analyst forecasts, but you can see how recent trends are positioning the company for the future by checking out our free Sun earnings, revenue and cash flow report.

Is sufficient revenue growth forecast for Sun?

There is a fundamental assumption that a company must significantly outperform the industry for P/S ratios like Sun’s to be considered reasonable.

Looking back, last year saw a frustrating 67% drop in sales. This means that the company has also experienced a long-term decline in sales, with sales falling by a total of 65% over the last three years. So it’s fair to say that the recent sales growth has been unwelcome for the company.

When compared to the industry, which is forecast to grow by 3.0 percent over the next twelve months, the company’s downward momentum based on its latest medium-term sales figures paints a sobering picture.

Given this information, we find it concerning that Sun is trading at a higher price-to-earnings ratio than the industry average. It seems that most investors are ignoring the recent weak growth rate and hoping for a turnaround in the company’s business prospects. Only the bravest would assume that these prices are sustainable, as a continuation of recent revenue trends will likely ultimately weigh heavily on the share price.

The last word

The sharp rise in the share price has also led to a rapid increase in Sun’s price-to-sales ratio. Normally, we would caution against reading too much into the price-to-sales ratio when making investment decisions, although it can say a lot about what other market participants think of the company.

Our research into Sun found that declining revenues over the medium term do not translate into as low a P/S ratio as we expected, as the industry is geared towards growth. At the moment, we are not comfortable with the high P/S ratio, as this revenue trend is most likely not going to sustain such positive sentiment for long. Unless recent medium-term conditions improve significantly, investors will find it difficult to accept the share price as a fair value.

It is always necessary to consider the ever-present specter of investment risk. We have found 1 warning sign with sunand understanding it should be part of your investment process.

If you are looking for companies with solid earnings growth in the pastyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.