Those who hold Orient Group Incorporation (SHSE:600811) shares would be relieved to see the share price rise 34% over the past thirty days, but the price will need to continue rising to repair the recent damage it has done to investors’ portfolios. Not all shareholders will be cheering, as the share price is still down a very disappointing 44% over the past twelve months.

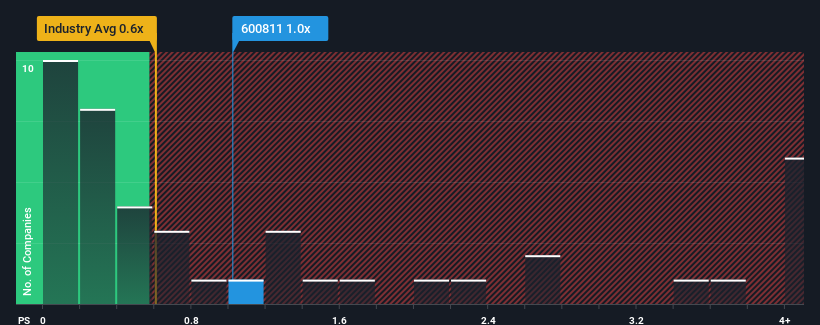

Despite the significant price increase, it is not an exaggeration to say that Orient Group Incorporation’s price-to-sales (or “P/S”) ratio of 1x seems pretty “average” right now, compared to the retail distribution industry in China, where the median P/S ratio is around 0.6x. While this may not be surprising, if the P/S ratio is not justified, investors could miss a potential opportunity or ignore an impending disappointment.

Check out our latest analysis for Orient Group Incorporation

What is the recent performance of Orient Group Incorporation?

As an example, Orient Group Incorporation’s revenues have declined over the past year, which is not ideal at all. One possibility is that the P/S is moderate because investors believe the company could still do enough in the near future to keep up with the broader industry. If you like the company, you at least hope that’s the case so you can potentially buy some shares while it’s not exactly popular.

Do you want a complete overview of the company’s profit, sales and cash flow? Then free The report on Orient Group Incorporation will help you shed light on the group’s historical performance.

How is Orient Group Incorporation’s sales growth developing?

To justify its P/S ratio, Orient Group Incorporation would need to achieve industry-like growth.

First, if we look back, the company’s revenue growth last year was not exactly exciting as it recorded a disappointing 56% decline. As a result, the revenues from three years ago have also fallen by a total of 71%. Therefore, it is fair to say that the revenue growth has been undesirable for the company recently.

When compared to the industry, which is forecast to grow by 14 percent over the next twelve months, the company’s downward momentum based on its latest medium-term sales figures paints a sobering picture.

Given this information, we find it concerning that Orient Group Incorporation is trading at a fairly similar price-to-earnings ratio compared to the industry. It appears that many of the company’s investors are far less pessimistic than its recent history would suggest and are not willing to offload their shares at this time. Only the bravest would assume that these prices are sustainable, as a continuation of recent sales trends will likely weigh on the share price at some point.

The last word

Orient Group Incorporation stock has gained a lot of momentum recently, which has brought its price-to-sales ratio in line with the rest of the industry. It is argued that the price-to-sales ratio is a poor indicator of value in certain industries, but it can be a strong indicator of business sentiment.

We find it surprising that Orient Group Incorporation trades at a P/S ratio comparable to the rest of the industry despite declining revenues over the medium term, while the industry as a whole is expected to grow. When we see a decline in revenues in the context of rising industry forecasts, it is reasonable to expect a potential decline in the share price on the horizon, driving the modest P/S lower. If recent medium-term revenue trends continue, shareholders’ investments will be at risk and potential investors will risk paying an unnecessary premium.

You should also inform yourself about these 3 warning signs we discovered with Orient Group Incorporation.

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.