The semiconductor industry has experienced tremendous growth over the past four decades. Chips have become an integral part of electronic devices such as computers and smartphones, to name a few. Increasing adoption of new technologies such as the Internet of Things (IoT) and artificial intelligence (AI) is expected to drive demand for semiconductors.

The manufacturing, healthcare, and retail industries have already integrated digital technologies that require robust semiconductor solutions. According to Fortune Business Insights, the global semiconductor industry is expected to register a compound annual growth rate of 14.9% from 2024 to 2032, reaching $2062.59 billion by 2032.

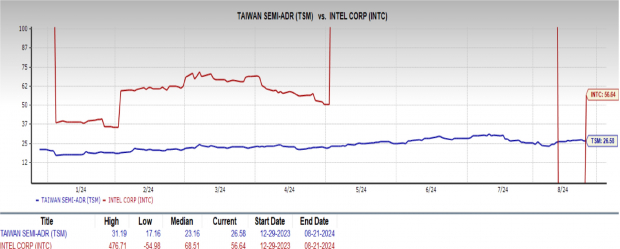

However, despite the positive trend, it is difficult to pick the best semiconductor stocks as their sales are constantly fluctuating. So here is a chip stock you should buy right now: Taiwan Semiconductor Manufacturing Company Limited (TSM – Free report) – and an industry bigwig to avoid – Intel Corporation (INTC – Free report).

2 reasons to be optimistic about TSM

Taiwan Semiconductor Manufacturing expects healthy demand for its chips as more companies begin to implement AI features in smartphones. Apple Inc.‘S (AAPL – The “Apple Intelligence” initiative to launch the iPhone 16 this fall is expected to boost demand for Taiwan Semiconductor Manufacturing’s chips. The new “Apple Intelligence” system has already brought benefits to Taiwan Semiconductor Manufacturing. Apple is one of Taiwan Semiconductor Manufacturing’s largest customers and accounts for about a quarter of TSM’s revenue.

Demand for AI applications such as Alphabet Inc.’S (GOOGLE – Free report) Gemini and Open AI’s ChatGPT have grown significantly. But such applications require huge amounts of data stored in data centers that rely on graphics processing units (GPUs) that NVIDIA Corporation (NVDA – Free Report). And without TSM’s manufacturing expertise, the GPUs cannot work. In a way, the increasing demand for AI applications would further increase Taiwan Semiconductor Manufacturing’s revenues in the next few years and lead to a rapid rise in its stock price.

Undoubtedly, Taiwan Semiconductor Manufacturing’s earnings prospects for the current year remain promising, with the Zacks Consensus Estimate for earnings per share at $6.45, up 11.4% from the year-ago figure.

Image source: Zacks Investment Research

Taiwan Semiconductor Manufacturing shares have already iShares Semiconductor ETF (SOXX – Free report) this year (+64.6% versus +22.6%).

Image source: Zacks Investment Research

2 reasons to be pessimistic about INTC

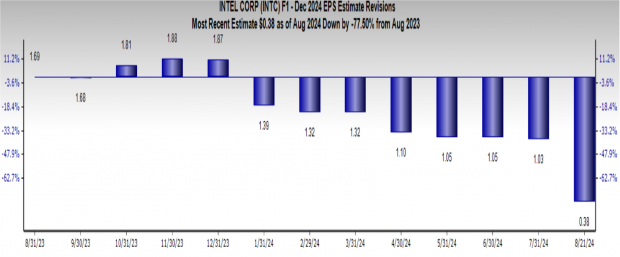

Intel is unfortunately losing its competitive advantage over its competitor For more information, visit: Advanced Micro Devices, Inc. (AMD – Free report). Intel is in a bind after failing to make much progress in its foundry business. AMD has made great strides in making high-performance processing machines. Intel’s failure to capitalize on the ever-growing AI application industry is alarming given the strong growth of Taiwan Semiconductor Manufacturing, which is currently the industry standard.

On the other hand, Arm Holdings plc (ARM – Free Report) is disrupting Intel’s server, storage and networking space. ARM’s designs in the microserver segment are supported by many of Intel’s competitors. As a result, Intel’s earnings outlook for the current year remains bleak, with the Zacks Consensus Estimate for earnings per share of $0.38 down a whopping 77.5% year over year.

Image source: Zacks Investment Research

Intel shares have underperformed the SOXX index so far this year, falling 57.4%. Both Taiwan Semiconductor Manufacturing and Intel are listed on the SOXX index.

Image source: Zacks Investment Research

TSM Basics – Very Strong

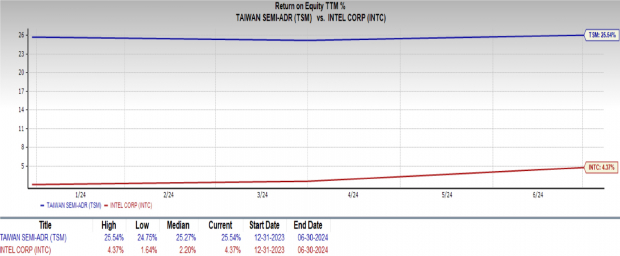

By the way, Taiwan Semiconductor Manufacturing has been generating better earnings than Intel. This is because TSM has a return on equity (ROE) of 25.5%, while Intel’s is around 4.4%. As a rule of thumb, anything above 20% is considered very strong in the first place.

Image source: Zacks Investment Research

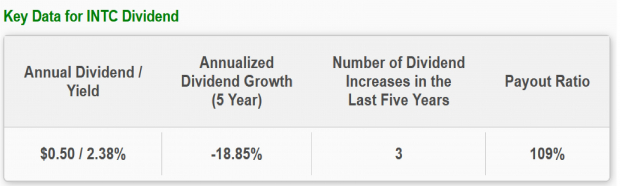

Taiwan Semiconductor Manufacturing pays solid dividends, suggesting a stable business model. Its dividend payout ratio is 31% of earnings, a low payout ratio that suggests the company reinvests most of its profits in research and development, which is essential for growth. Intel’s dividend payout ratio, on the other hand, is 109% of earnings, which is unsustainable.

Image source: Zacks Investment Research

TSM cheaper than INTC

Taiwan Semiconductor Manufacturing’s stock is cheaper than Intel’s, which has given the integrated circuit maker a leg up on the world’s largest semiconductor company. After all, buying INTC stock will burn a bigger hole in your wallet than buying TSM stock.

This is because TSM stock is currently trading at 26.5 times forward earnings according to the price-to-earnings ratio. However, INTC’s forward earnings multiple is 56.6 times.

Image source: Zacks Investment Research

TSM acquires Hand Over Fist

Taiwan Semiconductor Manufacturing is rightly a better buy than Intel because the company is well positioned to capitalize on growth in the AI space, has a consistent record of generating profits, and is valued lower.

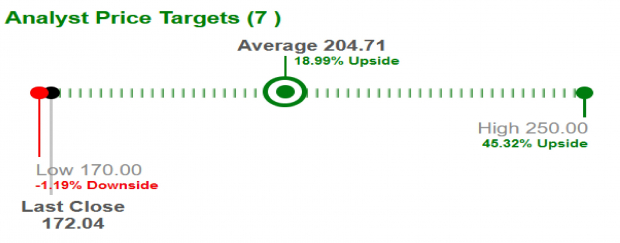

Reputable brokers have also raised TSM’s average short-term price target by nearly 19% from the company’s last closing price of $172.04. Analysts’ highest price target is $250.

Image source: Zacks Investment Research

Therefore, TSM has a Zacks Rank #2 (Buy). But INTC has a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.