When companies post strong earnings, stocks generally perform well, just like Tamtron Group Oyjs (HEL:TAMTRON) has recently rebounded. We have investigated and found other encouraging factors that investors will like.

Check out our latest analysis for Tamtron Group Oyj

How do unusual items affect profits?

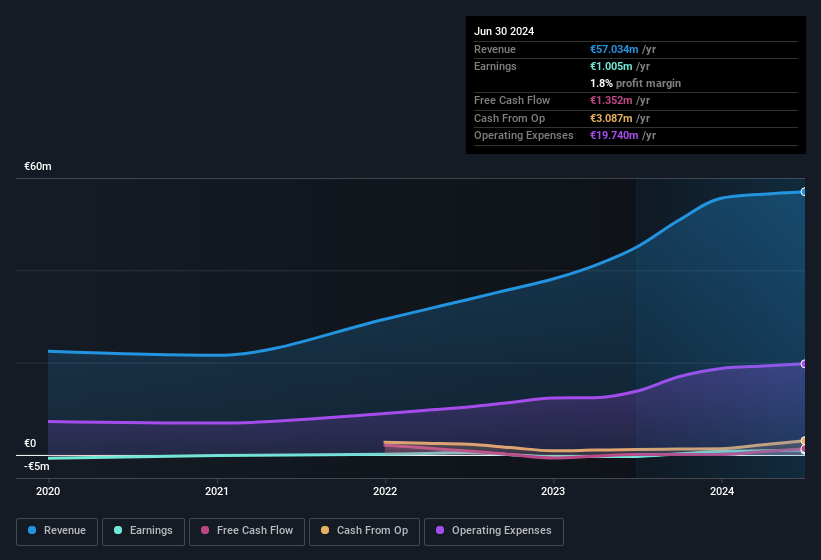

To properly understand Tamtron Group Oyj’s earnings results, we need to take into account the €2.1m that was due to unusual items. It’s never nice when unusual items cost the company profits, but on the plus side, things could improve sooner rather than later. When we analyzed the vast majority of listed companies globally, we found that significant unusual items are often not repeated. And that’s hardly surprising, given that these items are considered unusual. Tamtron Group Oyj took a pretty significant hit from unusual items in the year to June 2024. Therefore, we can assume that the unusual items made its statutory profit significantly weaker than it would otherwise be.

You may be wondering what analysts are predicting in terms of future profitability. Fortunately, you can click here to see an interactive chart depicting future profitability based on their estimates.

Our assessment of the profit development of Tamtron Group Oyj

As we discussed above, we believe that the significant unusual expenses will make Tamtron Group Oyj’s statutory profit lower than it would have been otherwise. Based on this observation, we think it’s possible that Tamtron Group Oyj’s statutory profit actually understates its earnings potential! And one can definitely see something positive in the fact that the company made a profit this year despite losing money last year. Of course, we’ve only scratched the surface when analyzing its earnings; one could also consider margins, forecast growth and return on capital, among other things. With that in mind, it’s important to be aware of the risks involved if you want to analyze the company in more detail. During our analysis, we found that Tamtron Group Oyj 3 warning signs and it would be unwise to ignore them.

This note has only examined a single factor that sheds light on the nature of Tamtron Group Oyj’s profits. But there is always more to discover if you are able to focus on the small details. Some people consider a high return on equity to be a good sign of a quality company. Although this may require a little research, you may find that free Collection of companies with high return on equity or this list of stocks with significant insider holdings may prove useful.

Valuation is complex, but we are here to simplify it.

Find out if Tamtron Group Oyj could be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.