To the annoyance of some shareholders SK IE Technology Co., Ltd. (KRX:361610) shares have fallen a whopping 25% over the past month, continuing the company’s terrible slide. The latest decline caps a disastrous 12 months for shareholders, who are sitting on a 66% loss during that time.

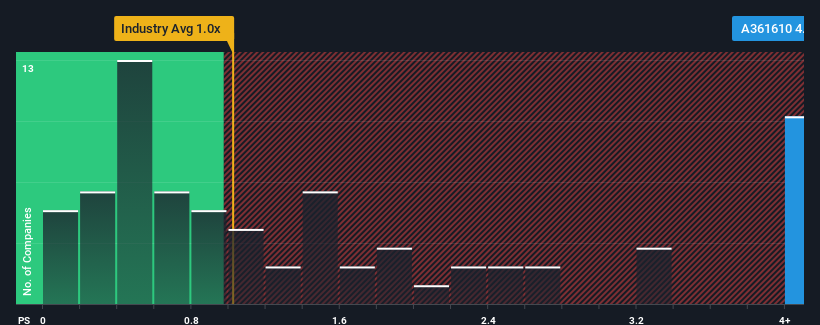

Although the price has dropped significantly, one might still think that SK IE Technology, with a price-to-sales ratio (or “P/S”) of 4.2x, is a stock to avoid, considering that nearly half of the companies in Korea’s electronics industry have a P/S ratio of under 1x. However, it’s not wise to simply take the P/S at face value, as there might be an explanation as to why it’s so high.

Check out our latest analysis for SK IE Technology

What is SK IE Technology’s recent performance?

While the industry has seen revenue growth recently, SK IE Technology’s revenue has gone into reverse, which is not good. Perhaps the market is expecting a reversal of the weak revenues, justifying the current high P/S. You really should hope so, otherwise you’re paying a pretty high price for no particular reason.

Do you want the full picture of analyst estimates for the company? Then our free The SK IE Technology report will help you find out what’s on the horizon.

How is SK IE Technology’s sales growth developing?

SK IE Technology’s price-to-sales ratio is typical of a company that is expected to deliver very strong growth and, importantly, significantly outperform the industry.

Looking back, last year brought a frustrating 7.0% decline in sales. That marred the most recent three-year period, which nonetheless saw a decent 10% increase in overall sales. While it’s been a bumpy ride, it’s still fair to say that the company’s sales growth has been mostly respectable recently.

As for the outlook, the company is expected to grow at a rate of 36% per year over the next three years, according to estimates by analysts covering the company. The rest of the industry, on the other hand, is only forecast to grow at a rate of 19% per year, which is significantly less attractive.

With this information, we can see why SK IE Technology is trading at such a high P/S ratio compared to the industry. It seems that most investors are anticipating this strong future growth and are willing to pay more for the stock.

Conclusion on SK IE Technology’s P/S

Even after such a sharp price drop, SK IE Technology’s price-to-sales ratio is still well above the industry average. Normally, we would caution against reading too much into the price-to-sales ratio when making investment decisions, although it can say a lot about what other market participants think of the company.

As we suspected, our study of SK IE Technology’s analyst forecasts found that its above-average revenue outlook is contributing to its high P/S ratio. Currently, shareholders are happy with the P/S as they are fairly confident that future revenue is not at risk. Unless the analysts are really wrong, these strong revenue forecasts should keep the share price high.

Before you take the next step, you should know about the 1 warning sign for SK IE Technology that we uncovered.

it is important, that Make sure you are looking for a great company and not just the first idea that comes to mind. So if increasing profitability matches your idea of a great company, take a look at this free List of interesting companies with strong recent earnings growth (and low P/E ratios).

New: Manage all your stock portfolios in one place

We have that the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Get in touch directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.