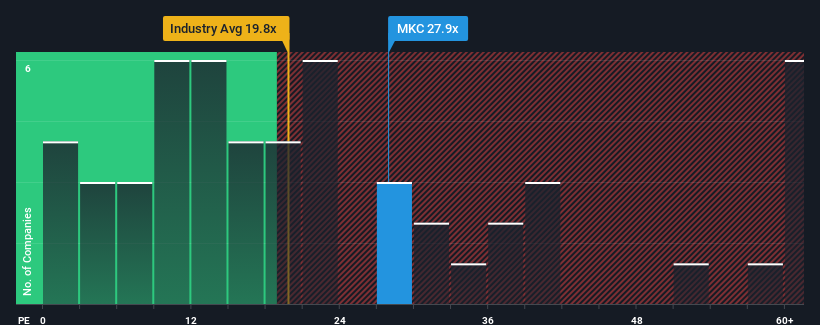

When nearly half of the companies in the United States have a price-to-earnings (P/E) ratio of less than 17x, you may consider McCormick & Company, Incorporated (NYSE:MKC) is a stock to avoid completely with its P/E ratio of 27.9. However, the P/E ratio might be quite high for a reason and further research is needed to determine if it is justified.

The last few years have been encouraging for McCormick, as earnings have increased despite declining market results. Many seem to expect the company to continue to defy general market adversities, which has increased investors’ willingness to pay more for the stock. If not, existing shareholders may be a little nervous about the future viability of the share price.

Check out our latest analysis on McCormick

If you want to know what analysts are predicting for the future, you should check out our free Report on McCormick.

How is McCormick’s growth developing?

McCormick’s P/E ratio would be typical of a company expected to have very strong growth and, importantly, significantly outperform the market.

First, if we look back, we can see that the company managed to grow earnings per share by a respectable 5.6% last year. However, this was not enough, as earnings per share declined by a dismal 2.3% overall over the last three-year period. Therefore, it is fair to say that earnings growth has been undesirable for the company recently.

According to analysts, earnings per share are expected to grow by 8.2% per year over the next three years, well below the 10% per year growth forecast for the overall market.

Given this information, we find it concerning that McCormick is trading at a higher P/E than the market. It appears that many investors in the company are much more optimistic than analysts indicate and are not willing to offload their shares at any price. There is a good chance that these shareholders are setting themselves up for future disappointment if the P/E falls to a level more in line with the growth prospects.

The conclusion on McCormick’s P/E ratio

In our opinion, the price-earnings ratio is not primarily used as a valuation tool, but rather to assess current investor sentiment and future expectations.

Our study of analyst forecasts for McCormick found that the poor earnings outlook is not affecting the high P/E nearly as much as we would have expected. At the moment, we are increasingly uncomfortable with the high P/E, as forecast future earnings are unlikely to sustain such positive sentiment for long. This puts shareholders’ investments at significant risk and potential investors at risk of paying an inflated premium.

You should always think about the risks. A typical example: We have 2 warning signs for McCormick You should be aware.

Naturally, You might also find a better stock than McCormick. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.