Ronglian Group Ltd. (SZSE:002642) shares have had a truly impressive month, gaining 26% after a shaky period earlier. While new buyers may be laughing, long-term holders may not be so pleased, as the latest gain only brings the stock back to where it started a year ago.

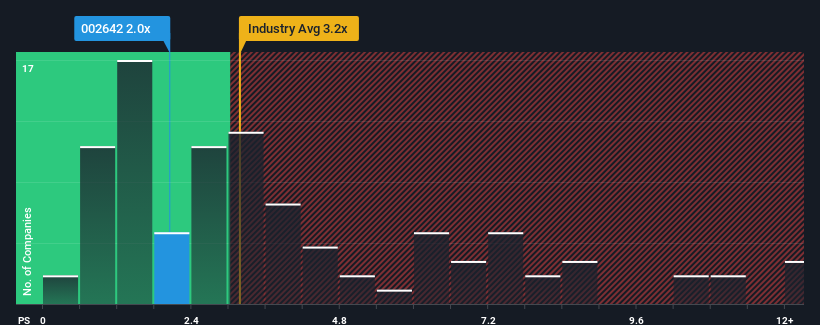

Although the price has risen sharply, Ronglian Group’s price-to-sales (or “P/S”) ratio of 2x might still make the company look like a buy right now, compared to the IT industry in China, where about half of the companies have a P/S ratio above 3.2x, and even P/S above 7x are quite common. Still, we would have to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Ronglian Group

What does Ronglian Group’s P/S mean for shareholders?

For example, Ronglian Group’s revenues have declined over the past year, which is far from ideal. Perhaps the market believes that the recent revenue performance is not good enough to sustain the industry, which is hurting the P/S ratio. Those who are bullish on Ronglian Group are hoping that this is not the case so they can buy the stock at a lower price.

We don’t have analyst forecasts, but you can see how recent trends are positioning the company for the future by checking out our free Report on earnings, sales and cash flow of the Ronglian Group.

Is sales growth forecast for the Ronglian Group?

To justify its price-to-sales ratio, Ronglian Group would have to show sluggish growth that lags behind the industry.

Looking back, last year saw a frustrating 37% drop in revenue. As a result, revenues from three years ago also fell by 32% overall. Accordingly, shareholders were disappointed with medium-term revenue growth rates.

When compared to the industry, which is forecast to grow by 25 percent over the next twelve months, the company’s downward momentum based on its latest medium-term sales figures paints a sobering picture.

With this in mind, it is understandable that Ronglian Group’s price-to-earnings ratio is below that of most other companies. However, we believe that declining revenues are unlikely to result in a stable price-to-earnings ratio over the long term, which could disappoint shareholders in the future. Even maintaining these prices could be difficult, with recent revenue trends already weighing on shares.

What can we learn from Ronglian Group’s P/S?

Ronglian Group’s share price has risen sharply recently, but its price-to-sales ratio remains modest. We usually caution against reading too much into the price-to-sales ratio when making investment decisions, although it can say a lot about what other market participants think of the company.

Our research into Ronglian Group confirms that the company’s declining revenues over the medium term are a key factor in the low price-to-sales ratio, given that the industry is forecast to grow. For now, shareholders accept the low price-to-sales ratio, admitting that future revenues are also unlikely to offer pleasant surprises. Unless recent medium-term conditions improve, they will continue to act as a barrier to the share price at these levels.

Another important area for risk analysis is the company’s balance sheet. free By conducting a balance sheet analysis for Ronglian Group with six simple checks, you can identify any risks that could pose a problem.

Naturally, Profitable companies with a history of strong earnings growth are generally safer bets. You may want to see this free Collection of other companies that have reasonable P/E ratios and strong earnings growth.

New: AI Stock Screeners and Alerts

Our new AI Stock Screener scans the market daily to uncover opportunities.

• Dividend powerhouses (3%+ yield)

• Undervalued small caps with insider purchases

• Fast-growing technology and AI companies

Or create your own from over 50 metrics.

Try it now for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.