- Bitcoin price is approaching the $58,700 level; a close below it could resume its downward move.

- Ethereum price falls below the ascending trend line, signaling a bearish trend in the future.

- Ripple price is retesting its 200-day EMA at $0.551; a break below it would indicate an impending bearish move.

Bitcoin (BTC) and Ripple (XRP) prices are approaching their key support levels; a close below them could signal a continuation of the downtrend. Ethereum (ETH) price has broken its ascending trend line, indicating a possible bearish reversal.

Bitcoin price faces a downtrend after closing below the $58,700 mark

Bitcoin price was rejected around the daily resistance level at $65,379 on Sunday and fell 7.5% over the next two days. It continued to trade slightly in the red on Wednesday, 0.1% lower, at $59,368.

If the BTC price continues to decline and closes below the $58,783 level, it could drop another 4.5% and retest its daily support at $56,002.

The Relative Strength Index (RSI) on the daily chart has slipped below its neutral value of 50, and the Awesome Oscillator (AO) is on track to close below its neutral value of zero. If both indicators are to trade below their neutral values, it will indicate weak momentum and an impending bearish trend.

BTC/USDT daily chart

However, if Bitcoin price finds support around $58,783 and closes above it, the bearish thesis will be invalidated and BTC could gain 11% and revisit its daily resistance level at $65,379.

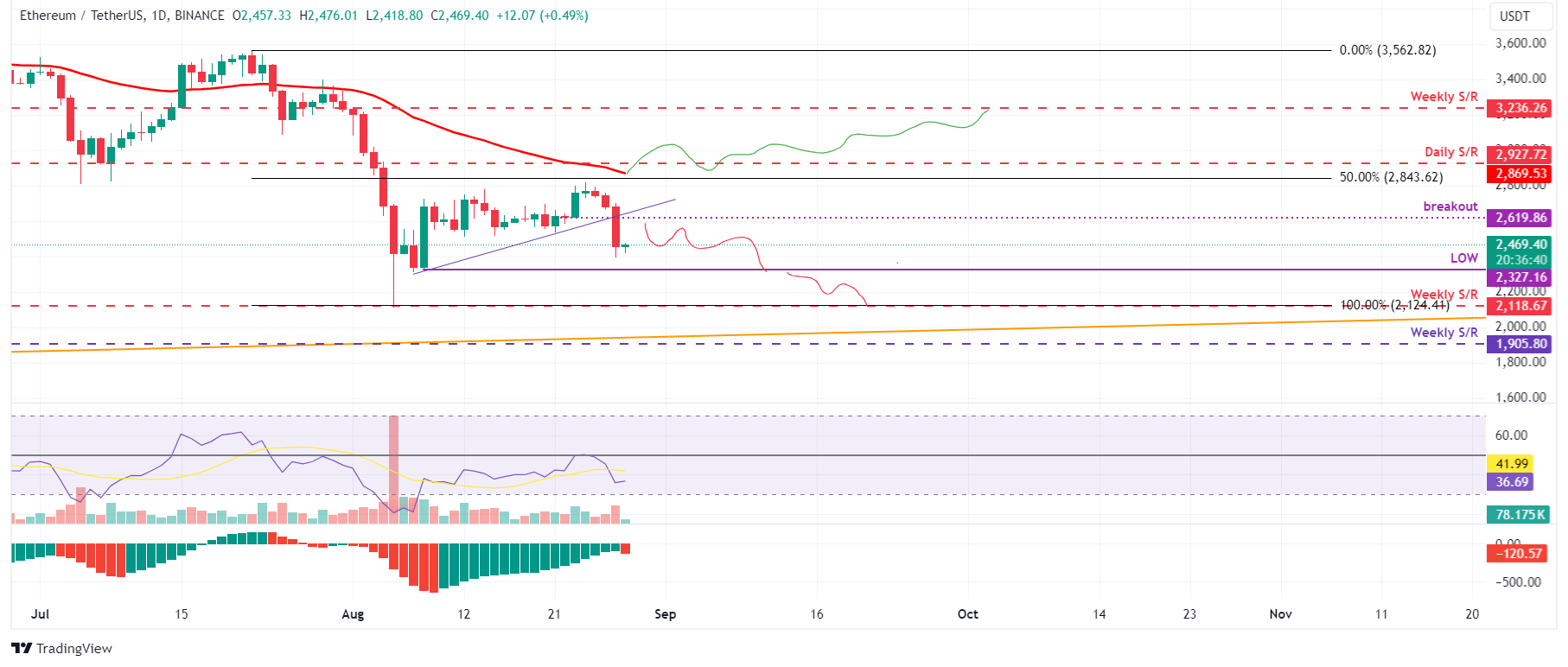

Ethereum price faces decline after trendline break

Ethereum price is facing resistance around the 50% price retracement level at $2,843, which roughly coincides with the daily resistance level at $2,927 and the 50-day exponential moving average (EMA) at $2,869 on Saturday. Over the next three days, it fell by 11%. At the time of writing on Wednesday, it is trading slightly up 0.6% at $2,469.

If ETH retraces and retests its broken ascending trend line at $2,619, it could further decline by 6% and retest its August 8 low at $2,327.

On the daily chart, RSI and AO are trading below their neutral levels of 50 and zero, respectively, indicating an impending bearish trend.

ETH/USDT daily chart

On the other hand, if ETH breaks the $2,843 level and closes above the daily resistance at $2,927, forming a higher high on the daily chart, this would invalidate the bearish thesis and it could rally 11% to retest its weekly resistance at $3,236.

Ripple price expected to fall if it closes below the 200-day EMA

Ripple price was retested on Saturday and rejected at its daily resistance level at $0.626. Over the next three days, it fell by 7.75% and re-reached its 200-day EMA at $0.551. On Wednesday, it traded slightly higher by 0.2% to reach $0.567.

If Ripple price continues to decline and closes below the 200-day EMA at $0.551, it could plunge 10% from its current trading level at $0.567, retesting its August 7 low of $0.492.

The RSI on the daily chart has slipped below its neutral level of 50, and the AO is on track to close below its neutral level of zero. For the bearish momentum to continue, both indicators need to trade below their neutral levels for the ongoing bearish trend.

XRP/USDT daily chart

However, if Ripple price closes above the daily resistance level of $0.626, it would shift the market structure by creating a higher high on the daily chart. This could result in a 5.3% increase and revisit the July 31 high of $0.658.