The TPK Holding Co., Ltd. (TWSE:3673) The share price has fallen by a significant 26% in the last 30 days, giving back much of the recent gains. Looking back over the last twelve months, the stock has nevertheless shown solid performance, with a price gain of 14%.

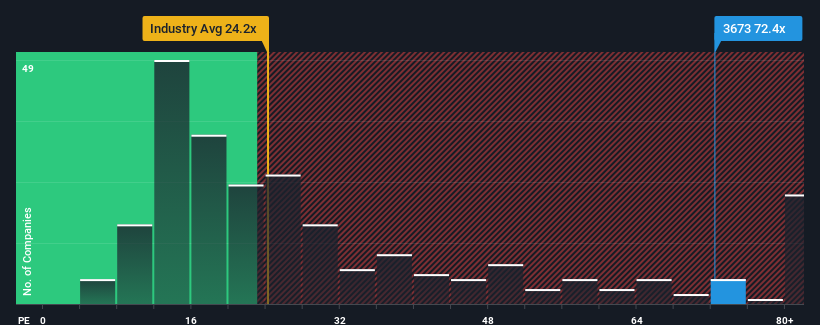

Although the price has dropped significantly, TPK Holding’s price-to-earnings (P/E) ratio of 72.4 may still be sending very bearish signals at the moment, as almost half of all companies in Taiwan have a P/E ratio of less than 22, and even P/E ratios below 15 are not uncommon. However, it is not advisable to simply take the P/E ratio at face value, as there may be an explanation as to why it is so high.

While the market has been seeing earnings growth recently, TPK Holding’s earnings have been in reverse gear, which is not good. It could be that many are expecting the dismal earnings performance to rebound significantly, which has prevented the P/E ratio from collapsing. One would really hope so, otherwise one is paying quite a high price for no particular reason.

Check out our latest analysis for TPK Holding

If you want to know what analysts are predicting for the future, you should check out our free Report on TPK Holding.

How is TPK Holding growing?

TPK Holding’s P/E ratio would be typical of a company that is expected to have very strong growth and, importantly, significantly outperform the market.

Looking back, the last year has seen the company experience a frustrating 46% decline in earnings. This means that it has also experienced a decline in earnings over the long term, with earnings per share falling by a total of 83% over the last three years. So it’s fair to say that the recent earnings growth has been unwelcome for the company.

Looking ahead, estimates from one analyst who covers the company suggest earnings will grow 294% next year, well above the 23% growth forecast for the overall market.

With this information, we can see why TPK Holding is trading at such a high P/E compared to the market. It seems that most investors are expecting this strong future growth and are willing to pay more for the stock.

What can we learn from TPK Holding’s P/E ratio?

TPK Holding’s shares may have slipped, but its P/E ratio is still high. We usually caution against reading too much into the price-to-earnings ratio when making investment decisions, although it can say a lot about what other market participants think of the company.

We have noted that TPK Holding maintains its high P/E ratio because its forecast growth is expected to be higher than the wider market. Currently, shareholders are happy with the P/E ratio because they are fairly confident that future earnings are not at risk. Under these circumstances, it is difficult to imagine the share price falling much in the near future.

You should always think about the risks. A typical example: We have 1 warning signal for TPK Holding You should be aware.

If you uncertain about the strength of TPK Holding’s businesswhy not explore our interactive stock list with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we are here to simplify it.

Find out if TPK Holding could be undervalued or overvalued with our detailed analysis, with Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.