Let’s talk about the popular Elastic NV (NYSE:ESTC). The company’s shares have seen a decent 13% increase in price on the NYSE over the past few months. While this is good news for shareholders, the company has traded significantly higher over the past year. Since many analysts cover the large-cap stock, we can assume that any price-related announcements have already been factored into the stock price. However, could the stock still be trading at a relatively cheap price? Today, we will analyze the latest data on Elastic’s outlook and valuation to see if the opportunity still exists.

Check out our latest analysis for Elastic

What opportunities does Elastic offer?

According to our valuation model, the stock appears to be fairly valued right now. It’s trading about 15% below our intrinsic value, meaning you’d be paying a fair price for it if you buy Elastic today. And if you believe the stock is actually worth $123.00, then there’s not much room for the stock to rise beyond its current price. Moreover, Elastic’s share price could be more stable over time (relative to the market), as its low beta shows.

Can we expect growth from Elastic?

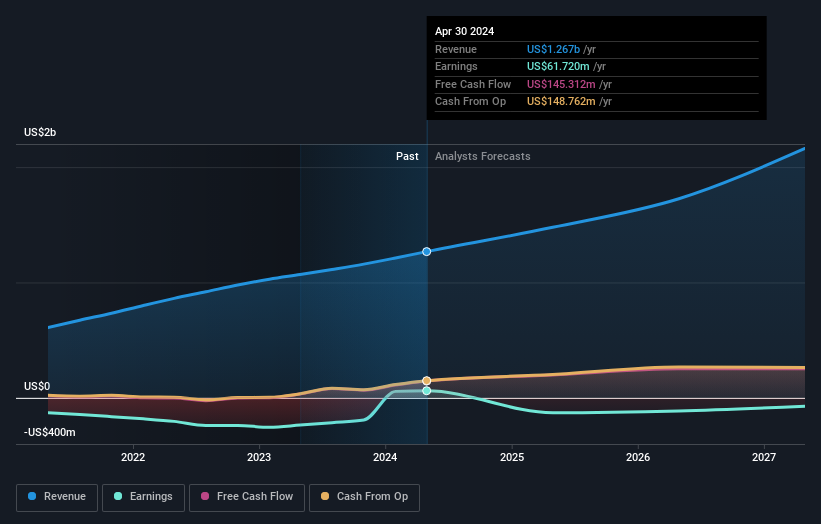

Investors seeking growth for their portfolio should check out a company’s prospects before buying its shares. Buying a great company with robust prospects at a cheap price is always a good investment, so let’s also take a look at the company’s future expectations. However, in the case of Elastic, the company is expected to deliver sharply negative earnings growth over the next few years, which does not help support its investment thesis. It seems that the risk of future uncertainty is high, at least in the near term.

What this means for you

Are you a shareholder? ESTC appears to be fairly valued at present, but given the uncertainty of negative returns in the future, now may be the right time to de-risk your portfolio. Is your current exposure to the stock optimal for your overall portfolio? And is the opportunity cost of holding a stock with a negative outlook too high? Before making a decision on the stock, check whether its fundamentals have changed.

Are you a potential investor? If you have been keeping an eye on ESTC for some time, now may not be the optimal time to buy as the price is trading around its fair value. The stock appears to be trading at fair value, which means you stand to gain less from mispricing. In addition, the negative growth forecast increases the risk of holding the stock. However, there are other important factors that we have not considered today that can help you solidify your view on ESTC should the price fall below its true value.

So if you want to delve deeper into this stock, it is important to consider all the risks it faces. To help you with that, we have found out 3 warning signs (1 is a bit uncomfortable!) that you should know before buying shares of Elastic.

If you are no longer interested in Elastic, you can see our list of over 50 other stocks with high growth potential on our free platform.

Valuation is complex, but we are here to simplify it.

Find out if Elastic is undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.