What is credit card rewards churning?

When you see advertisements from banks boasting about bonus cash rebates and reward points, it can be hard to resist the temptation to apply for a new card just to get those welcome bonuses. But is it really a smart financial move to apply for a card just to get a few extra points? The answer, like many other questions in the credit card space, is not a simple “yes” or “no.”

The process of credit card rewards churning involves applying for as many credit cards as possible. People do this just to get the very first credit card rewards, points and other rewards they own. After the user gets the rewards, they close and cancel the credit card account – which is a red flag for credit card issuers.

The idea of applying for a credit card based solely on the bonus is not new. Credit card churners have been doing this for years. Churners are individuals who frequently open and cancel bonus credit cards to earn miles, points, and cashback from welcome offers. After using up these bonuses, they quickly cancel their cards to avoid further costs in annual fees. In today’s market, this is an extremely lucrative hobby: Singapore has some of the most generous credit card offers in the world, and bonus credit cards are outdoing each other to win the business of regular consumers. Churners are simply taking money that is left on the table. However, this practice of “credit card churning” has its own pitfalls that should not be taken lightly.

Risk #1: Credit card rewards aren’t worth getting into debt, spending more than you can afford, or ruining your credit score

Churning requires some time and planning. Even opening a single credit card just to get the bonus can result in financial loss if you’re not careful. Churners are usually aware of these risks and avoid them at all costs. For example, you have to be sure that you can meet a card’s requirements to be eligible for its bonuses. Most cards only offer welcome offers to people who manage to add a certain amount to their card within a few months of opening the account. For example, the Citi PremierMiles Visa Card requires you to spend at least S$10,000 within the first three months to qualify for the 15,000 bonus miles offer. For many, this can put a huge strain on their monthly budget, especially if they use multiple credit cards at the same time.

You also need to consider annual fees. The Standard Chartered Visa Infinite Card, for example, charges users S$588.6 per year. Are you wondering if it’s worth it just because you want to earn 35,000 bonus miles? Consider the value of what you’ll get from the bonus and whether that justifies paying the fee. You should also ask yourself if you can afford to pay it. Even with cards that offer an annual fee waiver, the annual fee is charged immediately on your first monthly bill and refunded after you reach the minimum spend amount. You’d better have the funds needed to pay the fee back, otherwise you may be charged interest on your first bill.

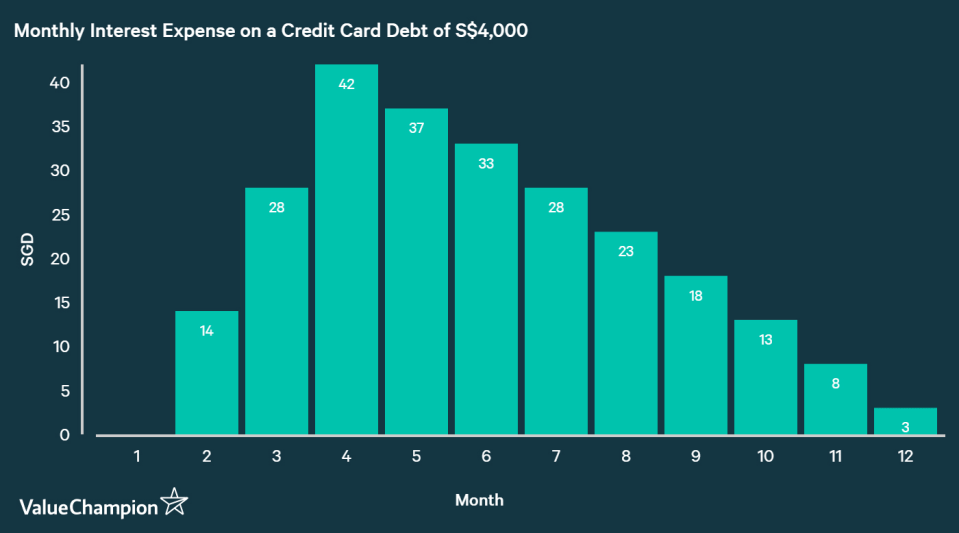

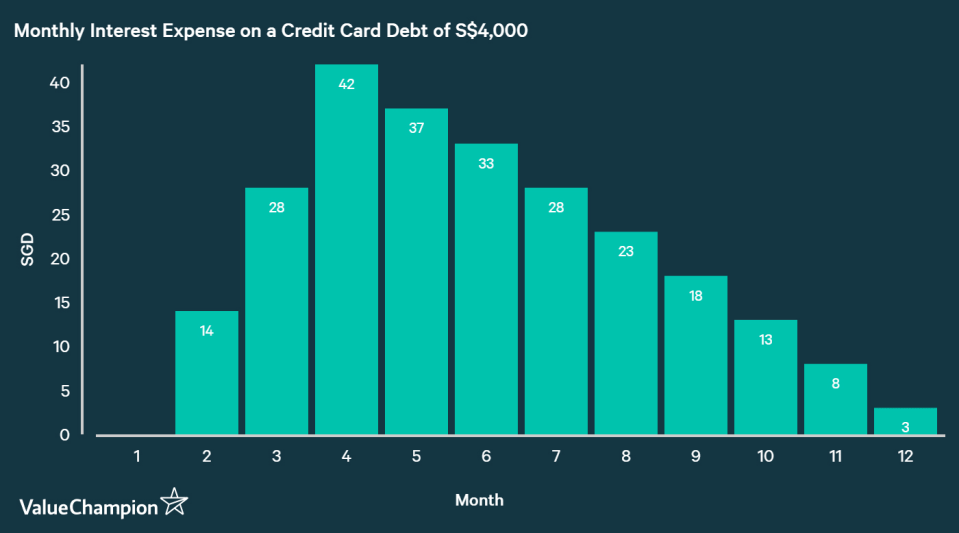

Let’s do a little math to prove that it’s not profitable to live beyond your means just to earn bonus miles. Tom has a monthly budget of S$2,000 and gets a new Citi PMV card. To get the 15,000 bonus miles, he spends S$10,000 in the first three months, which is S$4,000 more than he can afford. He may be happy about the 15,000 miles, but what he doesn’t realise is that he now has S$4,000 in credit card debt, on which he has to pay annual interest of 25%. Even if Tom reduced his monthly expenses to S$1,500 from the fourth month to pay off his debt of S$500 per month, he would end up paying S$245 in interest, which is significantly more than the S$150 he would have earned in miles (1 mile = S$0.01 for economy flights). This doesn’t even take into account the annual fee you had to pay!

Risk No. 2: If you open a card just because of the bonus, it can cause problems with the bank

Banks are increasingly cracking down on the practice of churning. While you can probably get away with it once or twice, it can be difficult to sustain over a long period of time. When issuers like DBS run big credit card bonus promotions, they accept the loss in the hope of gaining a long-term customer who could prove profitable over a long period of time. For this reason, most credit card promotions only apply to “new customers” who have not had an issuer’s card in the past 6 to 12 months. If a user cancels a card after receiving the bonus, they are reducing the profitability of those products. To discourage this behavior, some banks in the U.S. have already begun freezing accounts and points of people they suspect of having earned their bonuses this way.

In addition to everything we mentioned above, opening and closing a new account can impact your credit score. This could potentially have a negative impact if you need bank loans to buy a home or get quick cash for a personal emergency. For these reasons, frequent credit card use can hurt your chances of getting future credit card and loan applications approved at these banks.

The conclusion

While credit card rewards like S$180 cashback or 10,000 bonus miles can be lucrative, blindly chasing credit card rewards without considering your monthly budget can actually leave you worse off. The factors discussed above should make it clear that there is a lot to consider before you hit the apply button. Like churners, you can benefit greatly from snagging credit card rewards. However, you shouldn’t do so without properly understanding the intricacies involved. None of the individual topics are too difficult to understand. You just need to take the time to understand what you can afford and what you can get for it.

The article “When rewards card poaching becomes dangerous” originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimize your personal finances. Like us on our Facebook page to stay up to date with our latest news and articles.

More from ValueChampion: