Pandora A/S’ (CPH:PNDORA) The latest earnings report offered no surprises, with shares unchanged over the past week. We’ve done some digging and believe investors are missing some encouraging factors in the underlying numbers.

Check out our latest analysis for Pandora

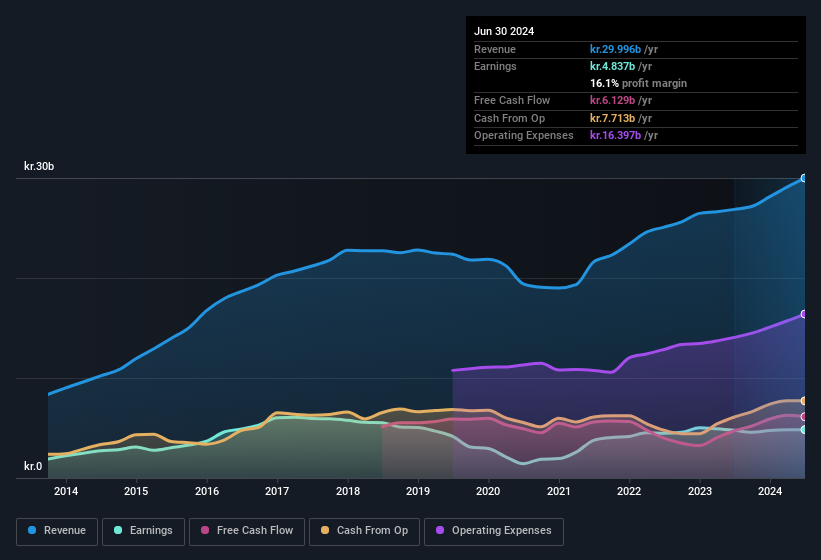

Looking at cash flow versus Pandora’s earnings

As finance nerds already know, Accrual ratio from cash flow is an important measure for assessing how well a company’s free cash flow (FCF) matches its profit. Simply put, this metric subtracts FCF from net profit and divides that number by the company’s average funds from operations for that period. You can think of the accrual ratio from cash flow as the “non-FCF profit ratio.”

Consequently, a negative accrual ratio is positive for the company, and a positive accrual ratio is negative. While an accrual ratio above zero is not a cause for concern, we think it is worth noting when a company has a relatively high accrual ratio. In particular, there is some academic evidence to suggest that a high accrual ratio is generally a bad sign for short-term earnings.

For the twelve months to June 2024, Pandora recorded an accrual ratio of -0.10. This suggests that its free cash flow was quite a bit higher than its statutory profit. In fact, the company had free cash flow of 6.1 billion krona last year, which was significantly higher than its statutory profit of 4.84 billion krona. Pandora’s free cash flow has been improving over the last year, which is generally pleasing.

You may be wondering what analysts are predicting in terms of future profitability. Fortunately, you can click here to see an interactive chart depicting future profitability based on their estimates.

Our assessment of Pandora’s earnings development

As we discussed above, Pandora has a perfectly satisfactory free cash flow to earnings ratio. Based on this observation, we think it is likely that Pandora’s statutory profit actually understates its earnings potential! And what’s more, its earnings per share have grown 55% per year over the past three years. Ultimately, it is important to consider more than just the factors mentioned above if you want to understand the company properly. With that in mind, it is important to be informed about the risks involved if you want to conduct further analysis of the company. You will be interested to know that we found 2 warning signs for Pandora and you’ll want to know more about these bad boys.

This note has only looked at a single factor that sheds light on the nature of Pandora’s earnings. But there is always more to discover if you are able to focus on the small details. For example, many people consider a high return on equity to indicate a favorable business situation, while others like to “follow the money” and look for stocks that insiders are buying. You may want to check this out. free Collection of companies with high return on equity or this list of stocks with high insider ownership.

New: Manage all your stock portfolios in one place

We have the the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of portfolios and see your total amount in one currency

• Be notified of new warning signals or risks by email or mobile phone

• Track the fair value of your stocks

Try a demo portfolio for free

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.