Many large-cap cryptocurrencies are up today, with Chainlink (LINK) seeing one of the biggest gains. Trailing only Polygon (MATIC), LINK’s price is up 10% in the last 24 hours.

Despite the surge, the altcoin could be on the verge of a decline and here’s why.

Indicators point to a possible decline in Chainlink

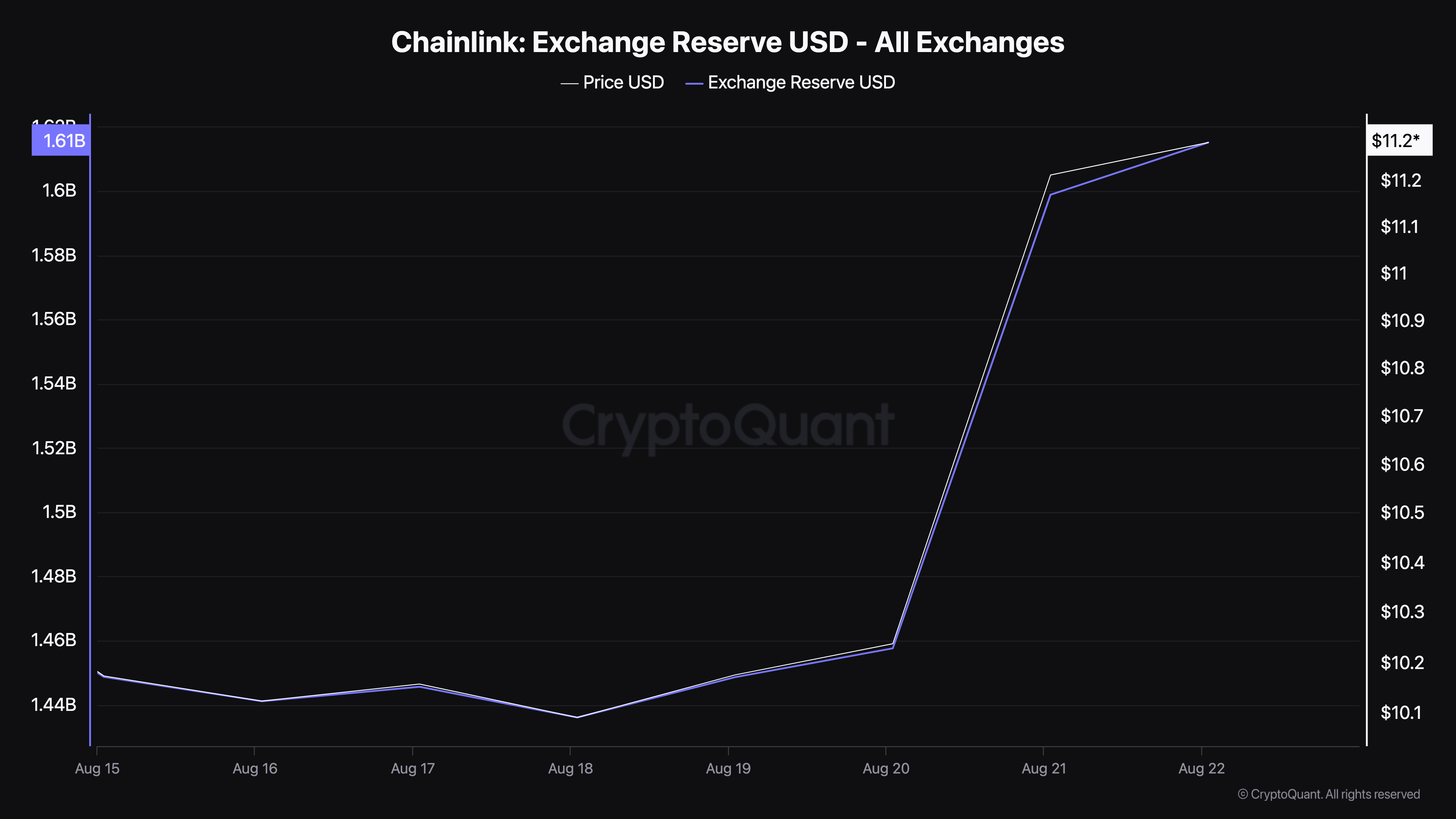

LINK price is in line with BeInCrypto’s recent prediction, which predicts a surge above $11, but data from CryptoQuant suggests that the rally could be short-lived.

Altcoin reserves on exchanges have reached their highest level since August 4. This metric tracks the total value of cryptocurrencies held across all exchanges. Typically, an increase signals potential selling pressure.

When long-term holders plan to hold onto a token, they usually move it off exchanges. On the other hand, when reserves decrease, it suggests that holders are removing tokens, which can reduce selling pressure and support price growth. In Chainlink’s case, the increase in reserves suggests that more tokens are returning to exchanges, reinforcing the notion that the current uptrend may be difficult to maintain.

Read more: What is Chainlink (LINK)?

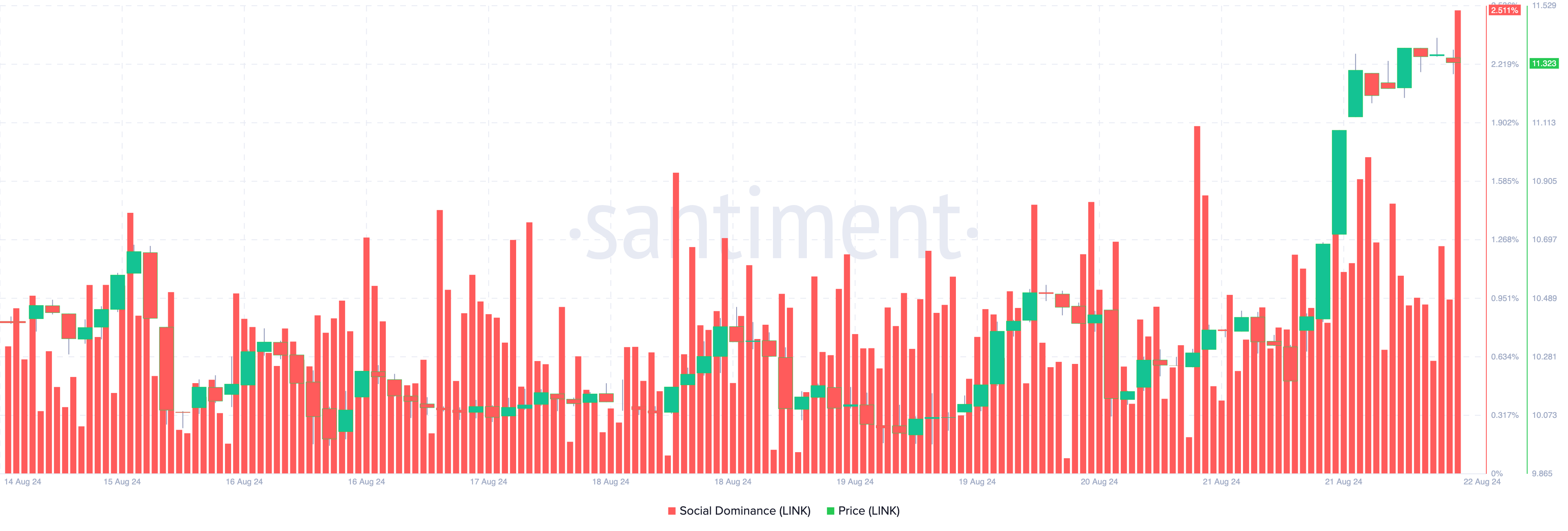

According to Santiment’s social dominance data, the cryptocurrency’s recent performance has attracted wider market attention and diverted focus from other assets. Social dominance measures how frequently a project is discussed compared to others in the top 100. Historically, increasing mentions often correlate with price movements.

Typically, a rise in social dominance leads to higher prices, but if the value becomes excessively high, it can be a sign of a potential price peak. This usually indicates a rise in fear of missing out (FOMO), where traders are quick to buy after significant price gains, even if the asset is approaching a local top.

If this pattern repeats itself, the LINK price could erase some of its recent gains.

LINK Price Prediction: Reversal on the Horizon

On the daily chart, LINK has formed a bearish pennant that could signal a pause in the current uptrend. A bearish pennant typically appears when three trend lines converge: the flagpole (resulting from an initial downtrend) and two lines that represent resistance during consolidation and support at lower levels.

Given the current FOMO atmosphere in the market, a bearish pennant could result in a breakdown below this pattern. If confirmed, the price of LINK could fall below $10 and possibly slide to $9.95. However, this scenario can be avoided if buying pressure increases, invalidating the bearish prediction and keeping the uptrend intact.

Read more: How to buy Chainlink (LINK) and everything you need to know

If the LINK price breaks out of the bearish pennant instead of falling lower, it could target the next resistance level at around $13.10. A successful move would change the market sentiment, potentially triggering further buying activity and invalidating the bearish pattern.

Disclaimer

Per the Trust Project’s guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions can change without notice. Always conduct your own research and consult a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.