Witbe SA (EPA:ALWIT) Shareholders who had been waiting for something were treated to a 26% drop in the share price over the past month. The latest drop caps a disastrous 12 months for shareholders who are sitting on a loss of 63% in that time.

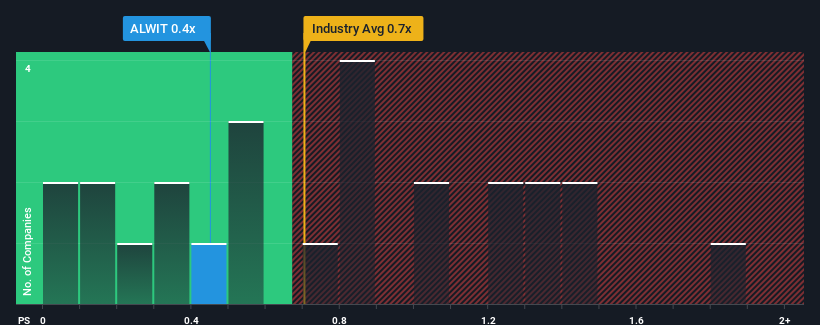

Even after such a sharp price drop, there will be few who would find Witbe’s price-to-sales ratio (or “P/S”) of 0.4 worth mentioning when the median P/S in the French IT industry is similar at around 0.7. However, it is not advisable to simply ignore the P/S without explanation, as investors may miss a special opportunity or a costly mistake.

Check out our latest analysis for Witbe

What does Witbe’s P/S mean for shareholders?

Witbe has been struggling recently as its revenue has declined faster than most other companies. Perhaps the market expects future revenue performance to be in line with the rest of the industry, which has prevented the P/S from declining. If you still believe in the company, you would much rather see the company grow its revenue. Or at least hope it doesn’t continue to underperform if you plan to buy shares while they are out of demand.

Do you want the full picture of analyst estimates for the company? Then our free The report on Witbe will help you find out what awaits us on the horizon.

How is Witbe’s sales growth developing?

To justify its price-to-sales ratio, Witbe would need to achieve industry-standard growth.

When reviewing last year’s financials, we were disappointed to see the company’s revenues decline by 11%. Nevertheless, the company has recorded an excellent overall revenue increase of 36% over the last three-year period, despite the unsatisfactory short-term performance. Accordingly, while shareholders would have preferred to see the recovery continue, medium-term revenue growth rates would certainly be welcomed.

According to an analyst who follows the company, sales are expected to increase by 5.6% next year, which is likely in line with the industry’s overall growth forecast of 4.6%.

With this information, we can see why Witbe is trading at a fairly similar price-to-earnings ratio to the industry. It seems that most investors expect average future growth and are only willing to pay a moderate amount for the stock.

The most important things to take away

With the share price plummeting, Witbe’s price-to-sales ratio appears to be in line with the rest of the IT industry. It is argued that the price-to-sales ratio is a poorer indicator of value in certain industries, but can be a meaningful indicator of business sentiment.

A Witbe’s price-to-earnings ratio seems about right to us, as analysts are forecasting a revenue outlook similar to that of the IT industry. For now, shareholders are happy with the price-to-earnings ratio, as they are fairly confident that future revenue will not hold any surprises. All in all, unless there are major shocks in the price-to-earnings and revenue estimates, it is hard to imagine the share price moving much in one direction or the other in the near future.

It is always necessary to consider the ever-present specter of investment risk. We have found 1 warning sign with Witbeand understanding it should be part of your investment process.

If you are looking for companies with solid earnings growth in the pastyou might want to see this free Collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we are here to simplify it.

Find out if Witbe might be undervalued or overvalued with our detailed analysis, including Fair value estimates, potential risks, dividends, insider trading and the company’s financial condition.

Access to free analyses

Do you have feedback on this article? Are you concerned about the content? Contact us directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.